U-Haul 2007 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2007 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 42

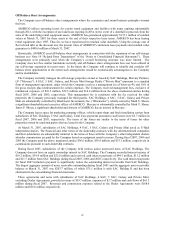

O

pany uses off-balance sheet arrangements where the economics and sound business principles warrant

th

value of AMERCO’ s minimum lease payments and residual value

g

nities to the extent such arrangements would be economically advantageous to the Company

an

by Mark V. Shoen.

Ja

are similar to the terms of leases for other

pr

s $36.6 million, $36.8 million and $33.1 million, respectively in

co

which $75.1 million is with SAC Holding II and has been

eli

and commission expenses related to the Dealer Agreements were $168.6

million and $36.6 million, respectively.

ff Balance Sheet Arrangements

The Com

eir use.

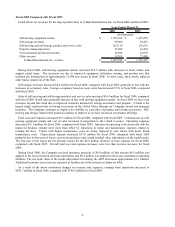

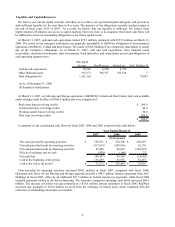

AMERCO utilizes operating leases for certain rental equipment and facilities with terms expiring substantially

through 2012, with the exception of one land lease expiring in 2034. In the event of a shortfall in proceeds from the

sales of the underlying rental equipment assets, AMERCO has guaranteed approximately $172.3 million of residual

values at March 31, 2007 for these assets at the end of their respective lease terms. AMERCO has been leasing

rental equipment since 1987. Thus far, we have experienced no residual value shortfalls. Using the average cost of

fleet related debt as the discount rate, the present

uarantees is $490.6 million at March 31, 2007.

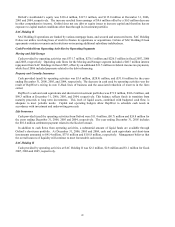

Historically, AMERCO used off-balance sheet arrangements in connection with the expansion of our self-storage

business (see Note 19 “Related Party Transactions” of the “Notes to Consolidated Financial Statements”). These

arrangements were primarily used when the Company’ s overall borrowing structure was more limited. The

Company does not face similar limitations currently and off-balance sheet arrangements have not been utilized in

our self-storage expansion in recent years. In the future the Company will continue to identify and consider off-

balance sheet opportu

d its stockholders.

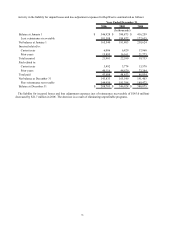

The Company currently manages the self-storage properties owned or leased by SAC Holdings, Mercury Partners,

LP (“Mercury”), 4 SAC, 5 SAC, Galaxy, and Private Mini Storage Realty (“Private Mini”) pursuant to a standard

form of management agreement, under which the Company receives a management fee of between 4% and 10% of

the gross receipts plus reimbursement for certain expenses. The Company received management fees, exclusive of

reimbursed expenses, of $23.5 million, $22.5 million and $14.4 million from the above mentioned entities during

fiscal 2007, 2006 and 2005, respectively. This management fee is consistent with the fee received for other

properties the Company previously managed for third parties. SAC Holdings, 4 SAC, 5 SAC, Galaxy and Private

Mini are substantially controlled by Blackwater Investments, Inc. (“Blackwater”), wholly-owned by Mark V. Shoen,

a significant shareholder and executive officer of AMERCO. Mercury is substantially controlled

mes P. Shoen, a significant shareholder and director of AMERCO, has an interest in Mercury.

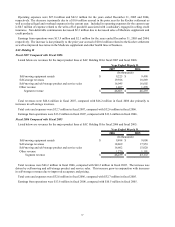

The Company leases space for marketing company offices, vehicle repair shops and hitch installation centers from

subsidiaries of SAC Holdings, 5 SAC and Galaxy. Total lease payments pursuant to such leases were $2.7 million in

fiscal 2007, 2006 and 2005, respectively. The terms of the leases

operties owned by unrelated parties that are leased to the Company.

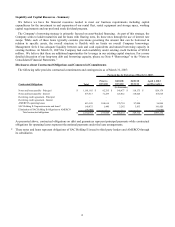

At March 31, 2007, subsidiaries of SAC Holdings, 4 SAC, 5 SAC, Galaxy and Private Mini acted as U-Haul

independent dealers. The financial and other terms of the dealership contracts with the aforementioned companies

and their subsidiaries are substantially identical to the terms of those with the Company’ s other independent dealers

whereby commissions are paid by the Company based on equipment rental revenues. During fiscal 2007, 2006 and

2005 the Company paid the above mentioned entitie

mmissions pursuant to such dealership contracts.

During fiscal 2007, subsidiaries of the Company held various junior unsecured notes of SAC Holdings. The

Company does not have an equity ownership interest in SAC Holdings. The Company recorded interest income of

$19.2 million, $19.4 million and $22.0 million and received cash interest payments of $44.5 million, $11.2 million

and $11.7 million from SAC Holdings during fiscal 2007, 2006 and 2005, respectively. The cash interest payments

for fiscal 2007 included a payment to significantly reduce the outstanding interest receivable from SAC Holdings.

The largest aggregate amount of notes receivable outstanding during fiscal 2007 and the aggregate notes receivable

balance at March 31, 2007 was $203.7 million, of

minated in the consolidating financial statements.

These agreements and notes with subsidiaries of SAC Holdings, 4 SAC, 5 SAC, Galaxy and Private Mini,

excluding Dealer Agreements, provided revenue of $39.7 million, expenses of $2.7 million and cash flows of $63.5

million during fiscal 2007. Revenues