U-Haul 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

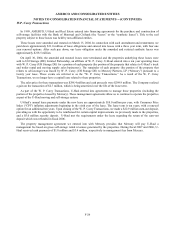

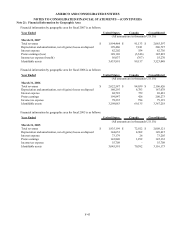

Premiums eliminated in consolidation were as follows:

RepWest Oxford

2006 $ - $ 1,191

2005 - 1,519

2004 - 1,474

(In thousands)

To the extent that a re-insurer is unable to meet its obligation under the related reinsurance agreements, RepWest would

remain liable for the unpaid losses and loss expenses. Pursuant to certain of these agreements, RepWest holds letters of

credit at years-end in the amount of $3.8 million from re-insurers and has issued letters of credit in the amount of $9.1

million in favor of certain ceding companies.

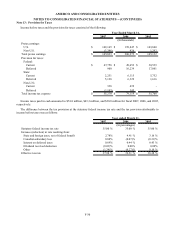

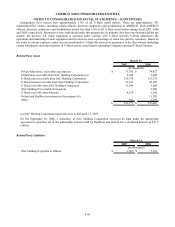

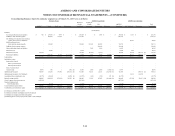

Policy benefits and losses, claims and loss expenses payable for RepWest were as follows:

2006 2005

Unpaid losses and loss adjustment expense $ 288,783 $ 346,928

Reinsurance losses payable 1,999 3,475

Unearned premiums 459 2,557

Total $ 291,241 $ 352,960

Year Ended December 31,

(In thousands)

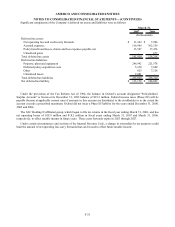

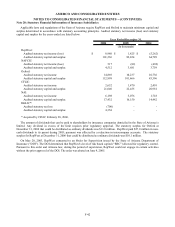

Activity in the liability for unpaid losses and loss adjustment expenses for RepWest is summarized as follows:

2006 2005 2004

Balance at January 1 $ 346,928 $ 380,875 $ 416,259

Less reinsurance recoverable 181,388 189,472 177,635

Net balance at January 1 165,540 191,403 238,624

Incurred related to:

Current year 6,006 6,429 17,960

Prior years 15,895 16,161 21,773

Total incurred 21,901 22,590 39,733

Paid related to:

Current year 3,492 3,774 13,570

Prior years 40,116 44,679 73,384

Total paid 43,608 48,453 86,954

Net balance at December 31 143,833 165,540 191,403

Plus reinsurance recoverable 144,950 181,388 189,472

Balance at December 31 $ 288,783 $ 346,928 $ 380,875

(In thousands)

Year Ended December 31,

F-36