U-Haul 2007 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2007 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 36

pany

2

sult of decreased surrender charge income of

$

ls from 2005, offset by a net

re

due to an

ad

due to the acquisition of DGLIC. DAC amortization in the life segment

in

ars ended December 31, 2006 and 2005,

re

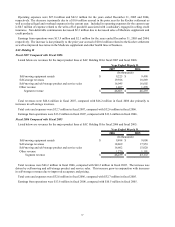

operations were $14.5 million and $13.9 million for the years ended December 31, 2006 and 2005,

2

sed

$

losses on the sale of investments in the current year.

In

s

d

er activity.

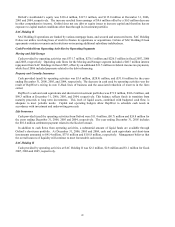

Other segments combined for a $0.5 million decrease primarily due to a decline in new business volume.

Oxford Life Insurance Com

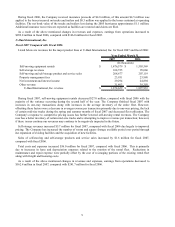

006 Compared with 2005

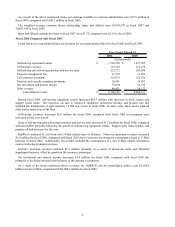

Net premiums were $121.6 million and $120.4 million for the years ended December 31, 2006 and 2005,

respectively. Medicare supplement premiums increased by $10.6 million primarily due to the acquisition of

DGLIC. The Company stopped writing new credit insurance business in 2006 and as a result, credit insurance

premiums decreased by $9.1 million. Other income was $4.7 million and $5.8 million for the years ended

December 31, 2006 and 2005 respectively. This decrease was the re

0.5 million and a decrease in administrative income of $0.6 million.

Net investment income was $22.5 million and $22.0 million for the years ended December 31, 2006 and 2005,

respectively. The increase was primarily due to a reduction in realized losses on disposa

duction in invested assets. Investment yields were consistent between the two years.

Benefits incurred were $88.3 million and $85.7 million, for the years ended December 31, 2006 and 2005,

respectively. This increase was primarily a result of a $3.8 million increase in Medicare supplement benefits due to

the acquisition of DGLIC, partially offset by a slightly improved loss ratio. Credit insurance benefits decreased $4.4

million due to decreased exposure. Other health benefits increased $1.1 million during the current period

justment for current claim trends. Life insurance benefits increased $1.4 million due to increased sales.

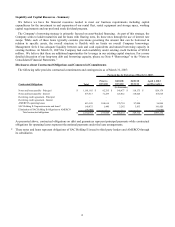

Amortization of deferred acquisition costs (DAC) and the value of business acquired (VOBA) was $15.1 million

and $21.4 million for the years ended December 31, 2006 and 2005, respectively. During the fourth quarter of 2005

and 2006, the Company made adjustments to the assumptions for expected future profits for the annuity business.

These included changes to the assumptions for lapse rates, interest crediting and investment returns. Amortization

expense was reduced by $4.7 million during 2006 as a result of these changes, including $1.3 million in the fourth

quarter of 2006. The credit business had a decrease of amortization of $3.2 million due to decreased business.

VOBA amortization increased $0.7 million

creased due to increased new business.

Operating expenses were $30.9 million and $27.0 million for the ye

spectively. The increase is primarily due to the acquisition of DGLIC.

Earnings from

respectively.

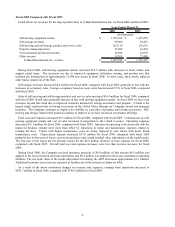

005 Compared with 2004

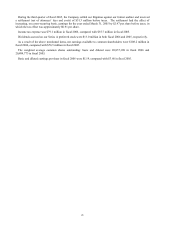

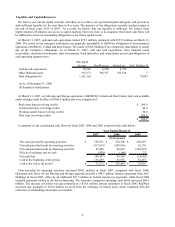

Net premiums were $120.4 million and $127.7 million for the years ended December 31, 2005 and 2004,

respectively. Medicare supplement premiums decreased by $5.7 million due to lapses on closed lines being greater

than new business written on active lines. Credit insurance premiums decreased $3.8 million. Oxford is no longer

writing credit insurance. Oxford expects the majority of the existing credit policies to earn out over the next three

years. Life premiums increased $1.6 million primarily due to increased sales from the final expense product.

Annuitizations increased $0.4 million, while other health premiums increased slightly. Other revenue decrea

2.5 million in the current year, compared to the prior year primarily due to decreased surrender charge income.

Net investment income was $22.0 million and $23.5 million for the years ended December 31, 2005 and 2004,

respectively. The decrease was primarily due to realized

vestment yields were consistent between the two years.

Benefits and losses incurred were $85.7 million and $91.5 million for the years ended December 31, 2005 and

2004, respectively. This decrease was primarily a result of a $5.4 million decrease in Medicare supplement benefit

ue to reduced exposure and a slightly improved loss ratio. All other lines combined for a $0.4 million decrease.

Amortization of deferred acquisition costs (DAC) and the value of business acquired (VOBA) was $21.4 million

and $23.8 million for the years ended December 31, 2005 and 2004, respectively. These costs are amortized for life

and health policies as the premium is earned over the term of the policy; and for deferred annuities in relation to

interest spreads. Annuity amortization decreased $1.9 million from 2004 primarily due to reduced surrend