U-Haul 2007 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2007 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 7

P

’ s Series A 8½ % Preferred Stock. The dividend was paid on June 1, 2007 to

.

F

urpose subsidiaries. These special-purpose subsidiaries will be consolidated into U-

ts.

R

07, A.M. Best Co. upgraded the financial strength ratings of RepWest to B (Fair) and set the

C

oking statements, whether in response to

een events, changed circumstances or otherwise.

It

related notes. These risk factors may be important in understanding this Annual Report on Form 10-K or elsewhere.

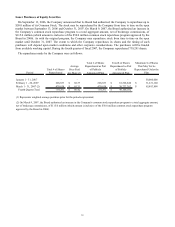

Recent Developments

referred Stock Dividends

On May 4, 2007, the Board of Directors of AMERCO (the “Board”) declared a regular quarterly cash dividend of

$0.53125 per share on the Company

holders of record on May 15, 2007

leet Securitization Transaction

The Company has entered into a securitized financing, as of June 1, 2007, through an offer by certain new special-

purpose entities of up to $217.0 million of Fixed Rate Series 2007-1-BT Notes and $86.6 million of Fixed Rate

Series 2007-1-CP Notes in a private placement transaction exempt from registration under the Securities Act of

1933, as amended. The new special-purpose entities that will issue the notes will be indirect subsidiaries of

AMERCO. These new special-purpose subsidiaries will use the net proceeds from the sale of the notes to, among

other things, acquire box trucks, cargo vans and pickup trucks from the manufacturers as well as from other

subsidiaries of AMERCO. The new special-purpose subsidiaries will generate income from truck and trailer rentals

to be used to service and repay the notes. The notes will not be obligations of AMERCO or any of its subsidiaries

other than the new special-p

Haul’ s financial statemen

epWest was upgraded

On May 30, 20

outlook as stable.

autionary Statement Regarding Forward-Looking Statements

This Annual Report on Form 10-K, contains “forward-looking statements” regarding future events and our future

results. We may make additional written or oral forward-looking statements from time to time in filings with the

SEC or otherwise. We believe such forward-looking statements are within the meaning of the safe-harbor provisions

of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934,

as amended. Such statements may include, but are not limited to, projections of revenues, earnings or loss; estimates

of capital expenditures, plans for future operations, products or services; financing needs and plans; our perceptions

of our legal positions and anticipated outcomes of government investigations and pending litigation against us;

liquidity; goals and strategies; plans for new business; growth rate assumptions, pricing, costs, and access to capital

and leasing markets as well as assumptions relating to the foregoing. The words “believe”, “expect”, “anticipate”,

“estimate”, “project” and similar expressions identify forward-looking statements, which speak only as of the date

the statement was made. Forward-looking statements are inherently subject to risks and uncertainties, some of which

cannot be predicted or quantified. Factors that could significantly affect results include, without limitation, the risk

factors enumerated at the end of this section, as well as the following: the Company’ s ability to operate pursuant to

the terms of its credit facilities; the Company’ s ability to maintain contracts that are critical to its operations; the

costs and availability of financing; the Company’ s ability to execute its business plan; the Company’ s ability to

attract, motivate and retain key employees; general economic conditions; fluctuations in our costs to maintain and

update our fleet and facilities; our ability to refinance our debt; changes in government regulations, particularly

environmental regulations; our credit ratings; the availability of credit; changes in demand for our products; changes

in the general domestic economy; the degree and nature of our competition; the resolution of pending litigation

against the Company; changes in accounting standards and other factors described in this report or the other

documents we file with the SEC. The above factors, the following disclosures, as well as other statements in this

report and in the Notes to Consolidated Financial Statements, could contribute to or cause such risks or

uncertainties, or could cause our stock price to fluctuate dramatically. Consequently, the forward-looking statements

should not be regarded as representations or warranties by the Company that such matters will be realized. The

Company assumes no obligation to update or revise any of the forward-lo

new information, unfores

em 1A.

Risk Factors

The following discussion of risk factors should be read in conjunction with Management’ s Discussion and

Analysis of Financial Condition and Results of Operations (“MD&A”), the consolidated financial statements and