U-Haul 2007 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2007 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

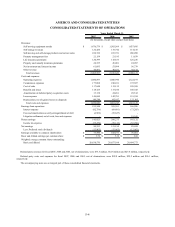

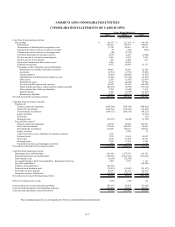

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

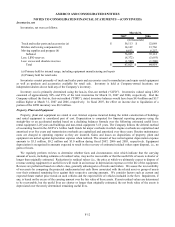

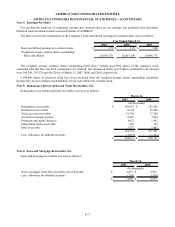

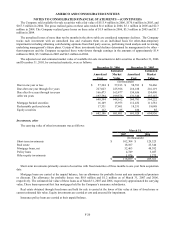

Inventories, net

Inventories, net were as follows:

2007 2006

Truck and trailer parts and accessories (a) $ 56,113 $ 52,089

Hitches and towing components (b) 14,169 13,766

Moving supplies and propane (b) 6,613 6,257

Subtotal 76,895 72,112

Less: LIFO reserves (8,372) (5,693)

Less: excess and obsolete reserves (1,500) (1,500)

Total $ 67,023 $ 64,919

(a) Primary held for internal usage, including equipment manufacturing and repair

(b) Primary held for retail sales

(In thousands)

March 31,

Inventories consist primarily of truck and trailer parts and accessories used to manufacture and repair rental equipment

as well as products and accessories available for retail sale. Inventory is held at Company-owned locations; our

independent dealers do not hold any of the Company’ s inventory.

Inventory cost is primarily determined using the last-in, first-out method (“LIFO”). Inventories valued using LIFO

consisted of approximately 96% and 95% of the total inventories for March 31, 2007 and 2006, respectively. Had the

Company utilized the first-in, first-out method (“FIFO”), stated inventory balances would have been $8.4 million and $5.7

million higher at March 31, 2007 and 2006, respectively. In fiscal 2007, the effect on income due to liquidation of a

portion of the LIFO inventory was $0.2 million.

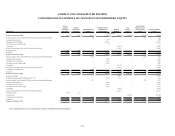

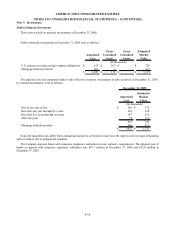

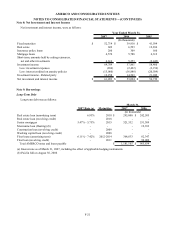

Property, Plant and Equipment

Property, plant and equipment are stated at cost. Interest expense incurred during the initial construction of buildings

and rental equipment is considered part of cost. Depreciation is computed for financial reporting purposes using the

straight-line or an accelerated method based on a declining balances formula over the following estimated useful lives:

rental equipment 2-20 years and buildings and non-rental equipment 3-55 years. The Company follows the deferral method

of accounting based in the AICPA’ s Airline Audit Guide for major overhauls in which engine overhauls are capitalized and

amortized over five years and transmission overhauls are capitalized and amortized over three years. Routine maintenance

costs are charged to operating expense as they are incurred. Gains and losses on dispositions of property, plant and

equipment are netted against depreciation expense when realized. The amount of loss netted against depreciation expense

amounts to $3.5 million, $9.2 million and $3.0 million during fiscal 2007, 2006 and 2005, respectively. Equipment

depreciation is recognized in amounts expected to result in the recovery of estimated residual values upon disposal, i.e., no

gains or losses.

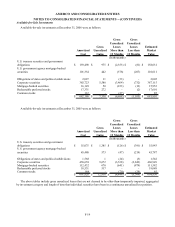

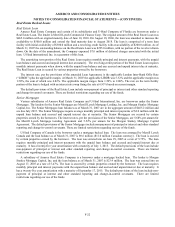

We regularly perform reviews to determine whether facts and circumstances exist which indicate that the carrying

amount of assets, including estimates of residual value, may not be recoverable or that the useful life of assets is shorter or

longer than originally estimated. Reductions in residual values (i.e., the price at which we ultimately expect to dispose of

revenue earning equipment) or useful lives will result in an increase in depreciation expense over the life of the equipment.

Reviews are performed based on vehicle class, generally subcategories of trucks and trailers. We assess the recoverability

of our assets by comparing the projected undiscounted net cash flows associated with the related asset or group of assets

over their estimated remaining lives against their respective carrying amounts. We consider factors such as current and

expected future market price trends on used vehicles and the expected life of vehicles included in the fleet. Impairment, if

any, is based on the excess of the carrying amount over the fair value of those assets. If asset residual values are determined

to be recoverable, but the useful lives are shorter or longer than originally estimated, the net book value of the assets is

depreciated over the newly determined remaining useful lives.

F-12