U-Haul 2007 Annual Report Download - page 74

Download and view the complete annual report

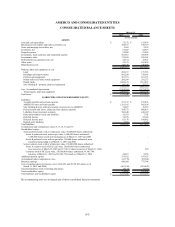

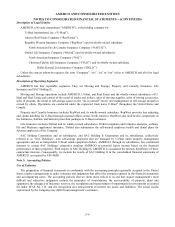

Please find page 74 of the 2007 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

Description of Legal Entities

AMERCO, a Nevada corporation (“AMERCO”), is the holding company for:

U-Haul International, Inc. (“U-Haul”),

Amerco Real Estate Company (“Real Estate”),

Republic Western Insurance Company (“RepWest”) and its wholly-owned subsidiary

North American Fire & Casualty Insurance Company (“NAFCIC”),

Oxford Life Insurance Company (“Oxford”) and its wholly-owned subsidiaries

North American Insurance Company (“NAI”)

Christian Fidelity Life Insurance Company (“CFLIC”) and its wholly-owned subsidiary

Dallas General Life Insurance Company (“DGLIC”)

Unless the context otherwise requires, the term “Company”, “we”, “us” or “our” refers to AMERCO and all of its legal

subsidiaries.

Description of Operating Segments

AMERCO has four reportable segments. They are Moving and Storage, Property and Casualty Insurance, Life

Insurance and SAC Holding II.

Moving and Storage operations include AMERCO, U-Haul, and Real Estate and the wholly-owned subsidiaries of U-

Haul and Real Estate and consist of the rental of trucks and trailers, sales of moving supplies, sales of towing accessories,

sales of propane, the rental of self-storage spaces to the “do-it-yourself” mover and management of self-storage properties

owned by others. Operations are conducted under the registered trade name U-Haul® throughout the United States and

Canada.

Property and Casualty Insurance includes RepWest and its wholly-owned subsidiary. RepWest provides loss adjusting

and claims handling for U-Haul through regional offices across North America. RepWest also underwrites components of

the Safemove, Safetow and Safestor protection packages to U-Haul customers.

Life Insurance includes Oxford and its wholly-owned subsidiaries. Oxford originates and reinsures annuities, ordinary

life and Medicare supplement insurance. Oxford also administers the self-insured employee health and dental plans for

Arizona employees of the Company.

SAC Holding Corporation and its subsidiaries, and SAC Holding II Corporation and its subsidiaries, collectively

referred to as “SAC Holdings”, own self-storage properties that are managed by U-Haul under property management

agreements and act as independent U-Haul rental equipment dealers. AMERCO, through its subsidiaries, has contractual

interests in certain SAC Holdings’ properties entitling AMERCO to potential future income based on the financial

performance of these properties. With respect to SAC Holding II, AMERCO is considered the primary beneficiary of these

contractual interests. Consequently, we include the results of SAC Holding II in the consolidated financial statements of

AMERCO, as required by FIN 46(R).

Note 3: Accounting Policies

Use of Estimates

The preparation of financial statements in conformity with the accounting principles generally accepted in the United

States requires management to make estimates and judgments that affect the amounts reported in the financial statements

and accompanying notes. The accounting policies that we deem most critical to us and that require management’ s most

difficult and subjective judgments include the principles of consolidation, the recoverability of property, plant and

equipment, the adequacy of insurance reserves, the recognition and measurement of impairments for investments accounted

for under SFAS No. 115, and the recognition and measurement of income tax assets and liabilities. The actual results

experienced by the Company may differ from management’ s estimates.

F-9