Tyson Foods 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

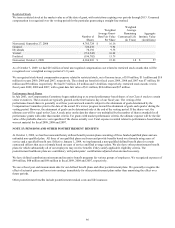

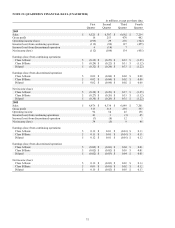

NOTE 18: INCOME TAXES

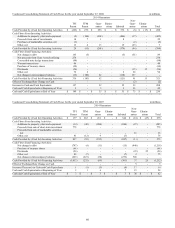

Detail of the provision for income taxes from continuing operations consists of the following:

in millions

2009

2008

2007

Federal

$

12

$

56

$

129

State

(2

)

8

16

Foreign

4

4

(3

)

$

14

$

68

$

142

Current

$

40

$

33

$

137

Deferred

(26

)

35

5

$

14

$

68

$

142

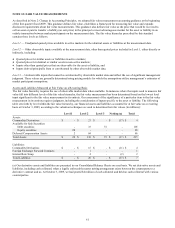

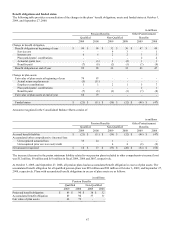

The reasons for the difference between the statutory federal income tax rate and our effective income tax rate from continuing

operations are as follows:

2009

2008

2007

Federal income tax rate

35.0

%

35.0

%

35.0

%

State income taxes, excluding unrecognized tax benefits

(0.1

)

2.0

2.3

Extraterritorial income exclusion

-

-

(1.1

)

Unrecognized tax benefits, net

(0.3

)

4.4

(4.6

)

Medicare Part D

-

(0.8

)

3.2

Goodwill impairment

(37.2

)

-

-

General business credits

2.3

(3.8

)

(2.6

)

Domestic production deduction

0.5

(2.2

)

(1.0

)

Fixed asset tax cost correction

-

-

4.2

Officers life insurance

(0.3

)

3.8

(1.4

)

Change in state valuation allowance

-

5.0

-

Change in foreign valuation allowance

(3.9

)

-

-

Tax planning in foreign jurisdictions

1.8

-

-

Other

(0.5

)

1.2

0.6

(2.7

)%

44.6

%

34.6

%

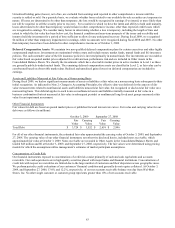

The fiscal 2009 goodwill impairment is non-deductible for income tax purposes and negatively impacted our effective income tax rate

by 37.2%. During fiscal 2009, our tax expense was impacted by an increase in foreign valuation allowance which increased tax

expense by $21 million, estimated general business credits which decreased tax expense by $12 million, and tax planning in foreign

jurisdictions which decreased tax expense by $9 million.

During fiscal 2008, an increase in the state valuation allowance increased tax expense by $8 million, while non-deductible activity

relating to company-owned life insurance increased tax expense by $6 million. The addition of unrecognized tax benefits in fiscal

2008 caused a net increase to income tax expense of $7 million. Additionally, estimated general business credits decreased fiscal

2008 tax expense by $6 million.

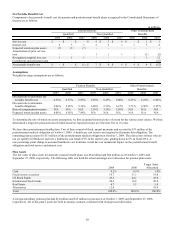

During fiscal 2007, we discovered a certain population of our tax cost and accumulated depreciation values were not accurately

recorded, primarily related to a property, plant and equipment system conversion in 1999. This system conversion did not impact the

recorded book value of the property, plant and equipment. As a result, the net tax basis of property, plant and equipment was

overstated, which caused the deferred tax liability in our financial statements to be understated. In fiscal 2007, we increased our

deferred tax liabilities $17 million and recognized additional tax expense of $17 million. Additionally, the fiscal 2007 effective tax

rate was reduced by 4.6% due to the reduction of income tax reserves management deemed were no longer required. The net

reduction to current income tax expense of approximately $20 million related to Internal Revenue Service examinations, appeals and

United States Tax Court settlement activity, as well as state income tax examination settlements. Additional related adjustments

resulted in a $28 million reduction of goodwill.

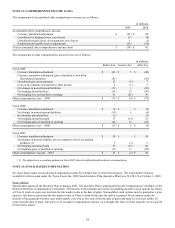

We recognize deferred income taxes for the future tax consequences attributable to differences between the financial statement

carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using

tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or

settled.