Tyson Foods 2009 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2009 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

agreement. Our maximum obligation associated with these programs is limited to the fair value of each participating livestock

supplier’s net tangible assets. Although we believe the aggregate maximum obligation under the program is unlikely to ever be

reached, the potential maximum obligation as of October 3, 2009, is approximately $250 million. The total receivables under these

programs were $72 million and $7 million at October 3, 2009 and September 27, 2008, respectively. Even though these programs are

limited to the net tangible assets of the participating livestock suppliers, we also manage a portion of our credit risk associated with

these programs by obtaining security interests in livestock suppliers' assets. After analyzing residual credit risks and general market

conditions, we have recorded an allowance for these programs' estimated uncollectible receivables of $20 million and $2 million at

October 3, 2009, and September 27, 2008, respectively.

Investments

The value of our investments in equity and debt securities, including our marketable debt securities, company-owned life insurance

and pension and other postretirement plan assets, has been impacted by the market volatility over the past year. These instruments

were recorded at fair value as of October 3, 2009. During fiscal 2009, we had a reduction in fair value resulting in the recognition

through earnings of $11 million.

We currently oversee two domestic and one foreign subsidiary non-contributory qualified defined benefit pension plans. All three

pension plans are frozen to new participants and no additional benefits will accrue for participants. Based on our 2009 actuarial

valuation, we anticipate contributions of $2 million to these plans for fiscal 2010. We also have one domestic unfunded defined

benefit plan. Based on our 2009 actuarial valuation, we anticipate contributions of $2 million to this plan for fiscal 2010.

Financial Instruments

As part of our commodity risk management activities, we use derivative financial instruments, primarily futures and options, to

reduce our exposure to various market risks related to commodity purchases. Similar to the capital markets, the commodities markets

have been volatile over the past year. Grain and some energy prices reached an all-time high during our fourth quarter of fiscal 2008

before falling sharply. While the reduction in grain and energy prices benefit us long-term, we recorded losses related to these

financial instruments in fiscal 2009 of $257 million. We have recently implemented policies to reduce our earnings volatility

associated with mark-to-market derivative activities, including more use of normal physical purchases and normal physical sales

which are not required to be marked to market.

Insurance

We rely on insurers as a protection against liability claims, property damage and various other risks. Our primary insurers maintain an

A.M. Best Financial Strength Rating of A or better. Nevertheless, we continue to monitor this situation as insurers have been and are

expected to continue to be impacted by the current capital market environment.

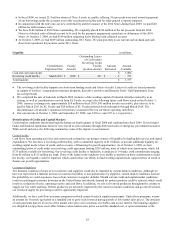

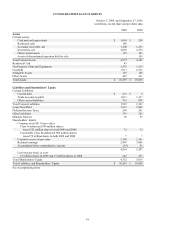

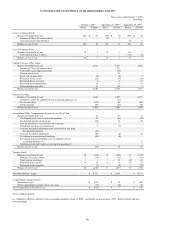

Capitalization

in millions

2009

2008

Senior notes

$

3,323

$

2,858

GO Zone tax-exempt bonds

100

-

Other indebtedness

129

38

Total Debt

$

3,552

$

2,896

Total Equity

$

4,352

$

5,014

Debt to Capitalization Ratio

44.9

%

36.6

%

●

In fiscal 2009, we issued $810 million of 2014 Notes. The 2014 Notes had an original issue discount of $59 million, based on

an issue price of 92.756% of face value. We used the net proceeds towards the repayment of our borrowings under our

accounts receivable securitization facility and for other general corporate purposes. In addition, Dynamic Fuels received $100

million in proceeds from the sale of Gulf Opportunity Zone tax-exempt bonds made available by the Federal government to

the regions affected by Hurricane Katrina and Rita in 2005. These floating rate bonds are due October 1, 2033.

●

In fiscal 2009, we bought back $293 million of notes, which included: $161 million 2011 Notes; $94 million 2010 Notes; and

$38 million 2016 Notes.

●

At October 3, 2009, we had a total of approximately $1.2 billion of cash and cash equivalents and restricted cash.