Tyson Foods 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

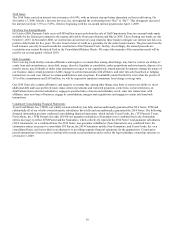

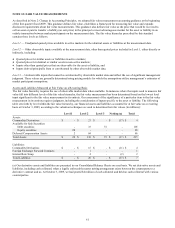

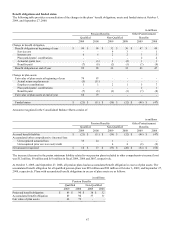

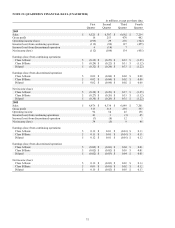

Restricted Stock

We issue restricted stock at the market value as of the date of grant, with restrictions expiring over periods through 2013. Unearned

compensation is recognized over the vesting period for the particular grant using a straight-line method.

Number of

Shares

Weighted

Average Grant-

Date Fair Value

Per Share

Weighted

Average

Remaining

Contractual Life

(in Years)

Aggregate

Intrinsic Value

(in millions)

Nonvested, September 27, 2008

4,765,724

$

16.16

Granted

726,238

9.94

Dividends

78,192

9.78

Vested

(716,542

)

16.64

Forfeited

(196,702

)

13.79

Nonvested, October 3, 2009

4,656,910

$

15.20

1.8

$ 57

As of October 3, 2009, we had $25 million of total unrecognized compensation cost related to restricted stock awards that will be

recognized over a weighted average period of 1.8 years.

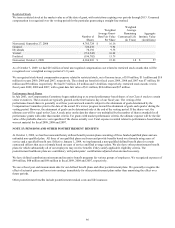

We recognized stock-based compensation expense related to restricted stock, net of income taxes, of $10 million, $11 million and $14

million for years 2009, 2008 and 2007, respectively. The related tax benefit for fiscal years 2009, 2008 and 2007 was $7 million, $6

million and $9 million, respectively. We had 0.7 million, 2.0 million and 3.4 million, respectively, restricted stock awards vest in

fiscal years 2009, 2008 and 2007, with a grant date fair value of $11 million, $24 million and $37 million.

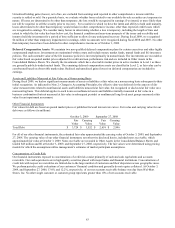

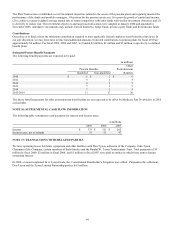

Performance-based Shares

In July 2003, our Compensation Committee began authorizing us to award performance-based shares of our Class A stock to certain

senior executives. These awards are typically granted on the first business day of our fiscal year. The vesting of the

performance-based shares is generally over three years and each award is subject to the attainment of goals determined by the

Compensation Committee prior to the date of the award. We review progress toward the attainment of goals each quarter during the

vesting period. However, the attainment of goals can be determined only at the end of the vesting period. If the shares vest, the

ultimate cost will be equal to the Class A stock price on the date the shares vest multiplied by the number of shares awarded for all

performance grants with other than market criteria. For grants with market performance criteria, the ultimate expense will be the fair

value of the probable shares to vest regardless if the shares actually vest. Total expense recorded related to performance-based shares

was not material for fiscal 2009, 2008 and 2007.

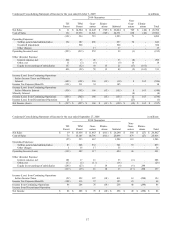

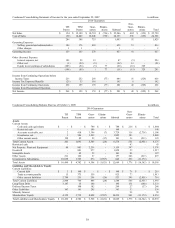

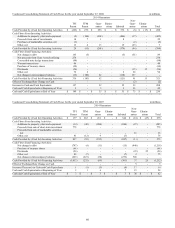

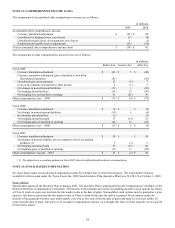

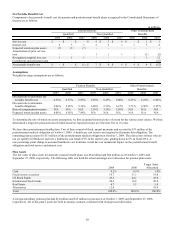

NOTE 15: PENSIONS AND OTHER POSTRETIREMENT BENEFITS

At October 3, 2009, we had four noncontributory defined benefit pension plans consisting of three funded qualified plans and one

unfunded non-qualified plan. All three of our qualified plans are frozen and provide benefits based on a formula using years of

service and a specified benefit rate. Effective January 1, 2004, we implemented a non-qualified defined benefit plan for certain

contracted officers that uses a formula based on years of service and final average salary. We also have other postretirement benefit

plans for which substantially all of our employees may receive benefits if they satisfy applicable eligibility criteria. The

postretirement healthcare plans are contributory with participants’ contributions adjusted when deemed necessary.

We have defined contribution retirement and incentive benefit programs for various groups of employees. We recognized expenses of

$49 million, $48 million and $46 million in fiscal 2009, 2008 and 2007, respectively.

We use a fiscal year end measurement date for our defined benefit plans and other postretirement plans. We generally recognize the

effect of actuarial gains and losses into earnings immediately for other postretirement plans rather than amortizing the effect over

future periods.

Other postretirement benefits include postretirement medical costs and life insurance.