Tyson Foods 2009 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2009 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

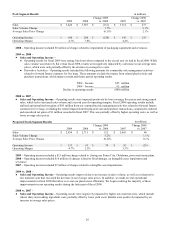

●

In fiscal 2008, we issued 22.4 million shares of Class A stock in a public offering. Net proceeds were used toward repayment

of our borrowings under the accounts receivable securitization facility and for other general corporate purposes.

●

In conjunction with the entry into our new credit facility and the issuance of the 2014 Notes during fiscal 2009, we paid $48

million for debt issuance costs.

●

We have $140 million of 2010 Notes outstanding. We originally placed $234 million of the net proceeds from the 2014

Notes in a blocked cash collateral account to be used for the payment, prepayment, repurchase or defeasance of the 2010

Notes. At October 3, 2009, we had $140 million remaining in the blocked cash collateral account.

●

At October 3, 2009, we had $839 million outstanding 2011 Notes. We plan presently to use current cash on hand and cash

flows from operations for payment on the 2011 Notes.

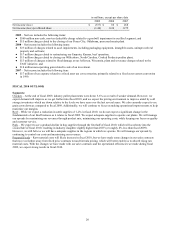

Liquidity

in millions

Commitments

Expiration Date

Facility

Amount

Outstanding Letters

of Credit under

Revolving Credit

Facility

(no draw downs)

Amount

Borrowed

Amount

Available

Cash and cash equivalents

$

1,004

Revolving credit facility

March 2012

$

1,000

$

267

$

-

$

733

Total liquidity

$

1,737

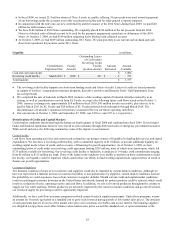

●

The revolving credit facility supports our short-term funding needs and letters of credit. Letters of credit are issued primarily

in support of workers’ compensation insurance programs, derivative activities and Dynamic Fuels’ Gulf Opportunity Zone

tax-exempt bonds.

●

We completed the sale of Lakeside in March 2009. Inclusive of the working capital of Lakeside initially retained by us at

closing, as well as consideration received from XL Foods, we expect the following future cash flows based on the October 3,

2009, currency exchange rate: approximately $10 million in fiscal 2010; $45 million in notes receivable, plus interest, to be

paid by March 2011 by XL Foods; and $24 million of XL Foods preferred stock redeemable through March 2014. The

discontinuance of Lakeside’s operation will not have a material effect on our future operating cash flows.

●

Our current ratio at October 3, 2009, and September 27, 2008, was 2.20 to 1 and 2.07 to 1, respectively.

Deterioration of Credit and Capital Markets

Credit market conditions deteriorated rapidly during our fourth quarter of fiscal 2008 and continued into fiscal 2009. Several major

banks and financial institutions failed or were forced to seek assistance through distressed sales or emergency government measures.

While not all-inclusive, the following summarizes some of the impacts to our business:

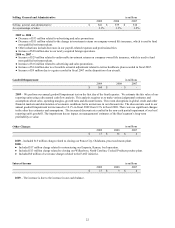

Credit Facility

Cash flows from operating activities and current cash on hand are our primary sources of liquidity for funding debt service and capital

expenditures. We also have a revolving credit facility, with a committed capacity of $1.0 billion, to provide additional liquidity for

working capital needs, letters of credit, and as a source of financing for growth opportunities. As of October 3, 2009, we had

outstanding letters of credit under our revolving credit agreement totaling $267 million, none of which were drawn upon, which left

$733 million available for borrowing. Our revolving credit facility is funded by a syndicate of 19 banks, with commitments ranging

from $6 million to $115 million per bank. If any of the banks in the syndicate were unable to perform on their commitments to fund

the facility, our liquidity could be impaired, which could reduce our ability to fund working capital needs, support letters of credit or

finance our growth opportunities.

Customers/Suppliers

The financial condition of some of our customers and suppliers could also be impaired by current market conditions. Although we

have not experienced a material increase in customer bad debts or non-performance by suppliers, current market conditions increase

the probability we could experience losses from customer or supplier defaults. Should current credit and capital market conditions

result in a prolonged economic downturn in the United States and abroad, demand for protein products could be reduced, which could

result in a reduction of sales, operating income and cash flows. In addition, we rely on livestock producers throughout the country to

supply our live cattle and hogs. If these producers are adversely impacted by the current economic conditions and go out of business,

our livestock supply for processing could be significantly impacted.

Additionally, we have cash flow assistance programs in which certain livestock suppliers participate. Under these programs, we pay

an amount for livestock equivalent to a standard cost to grow such livestock during periods of low market sales prices. The amounts

of such payments that are in excess of the market sales price are recorded as receivables and accrue interest. Participating suppliers

are obligated to repay these receivables balances when market sales prices exceed this standard cost, or upon termination of the