Tyson Foods 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

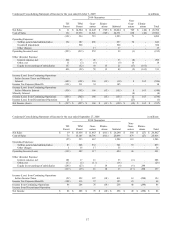

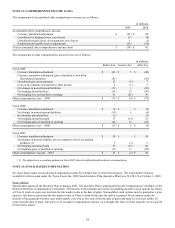

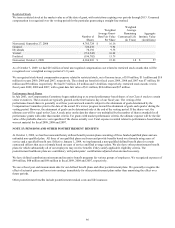

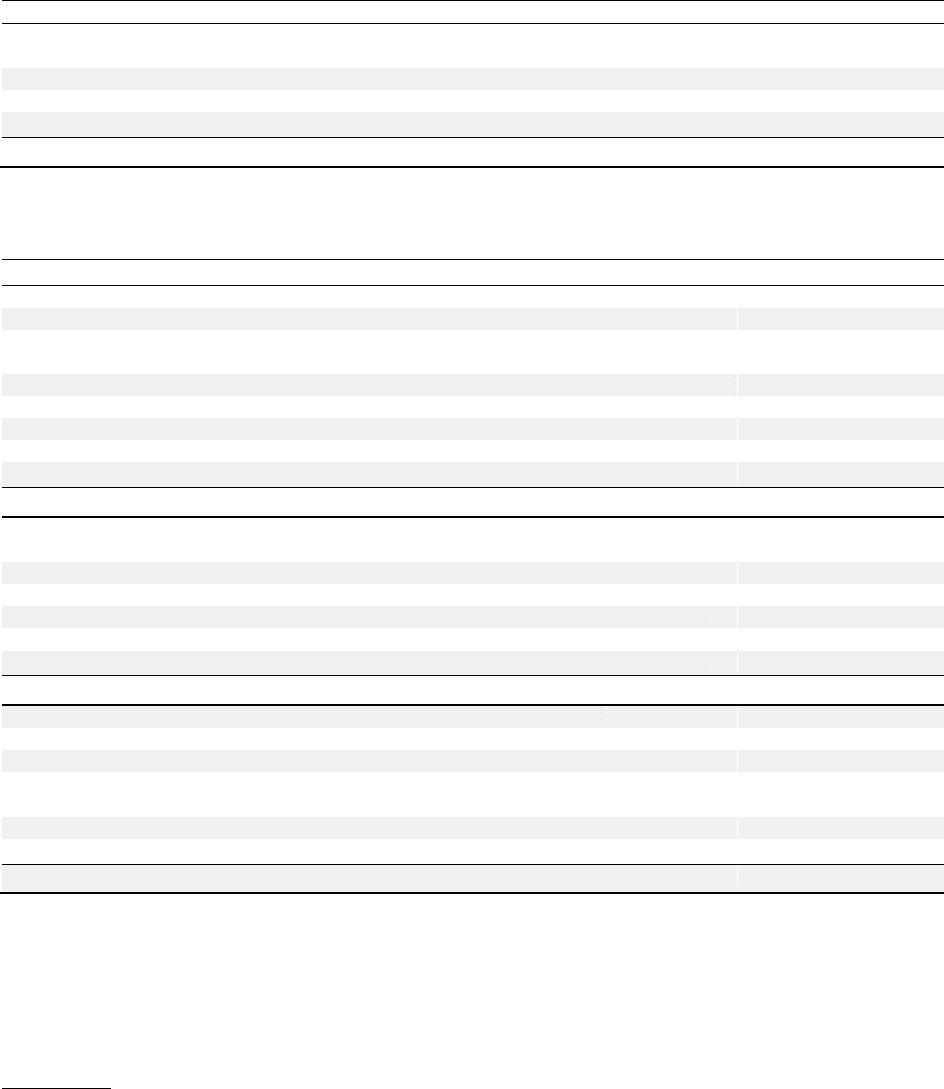

NOTE 13: COMPREHENSIVE INCOME (LOSS)

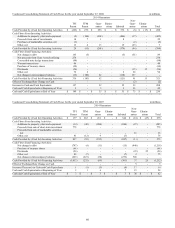

The components of accumulated other comprehensive income are as follows:

in millions

2009

2008

Accumulated other comprehensive income:

Currency translation adjustment

$

(21

)

$

60

Unrealized net hedging losses, net of taxes

(2

)

(8

)

Unrealized net gain (loss) on investments, net of taxes

9

(1

)

Postretirement benefits reserve adjustments

(20

)

(10

)

Total accumulated other comprehensive income (loss)

$

(34

)

$

41

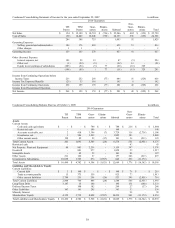

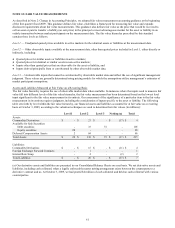

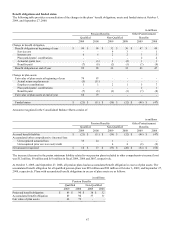

The components of other comprehensive income (loss) are as follows:

in millions

Before Tax

Income Tax

After Tax

Fiscal 2009:

Currency translation adjustment

$

(43

)

$

3

$

(40

)

Currency translation adjustment gain reclassified to loss from

discontinued operation

(41

)

-

(41

)

Unrealized gain on investments

12

(5

)

7

Loss on investments reclassified to other income

4

(1

)

3

Net change in postretirement liabilities

(11

)

1

(10

)

Net hedging unrealized loss

(53

)

23

(30

)

Net hedging loss reclassified to earnings

61

(25

)

36

Other comprehensive loss – 2009

$

(71

)

$

(4

)

$

(75

)

Fiscal 2008:

Currency translation adjustment

$

(2

)

$

-

$

(2

)

Net change in postretirement liabilities

(10

)

6

(4

)

Investments unrealized loss

(1

)

-

(1

)

Net hedging unrealized gain

37

(14

)

23

Net hedging gain reclassified to earnings

(41

)

16

(25

)

Other comprehensive loss – 2008

$

(17

)

$

8

$

(9

)

Fiscal 2007:

Currency translation adjustment

$

24

$

-

$

24

Net change in pension liability, prior to adoption of new accounting

guidance (1)

9

(3

)

6

Net hedging unrealized gain

33

(13

)

20

Net hedging gain reclassified to earnings

(33

)

13

(20

)

Other comprehensive income – 2007

$

33

$

(3

)

$

30

(1) We adopted new accounting guidance in fiscal 2007 related to defined benefit and post retirement plans.

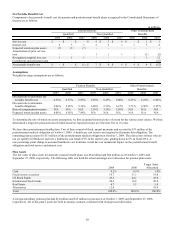

NOTE 14: STOCK-BASED COMPENSATION

We issue shares under our stock-based compensation plans by issuing Class A stock from treasury. The total number of shares

available for future grant under the Tyson Foods, Inc. 2000 Stock Incentive Plan (Incentive Plan) was 22,320,132 at October 3, 2009.

Stock Options

Shareholders approved the Incentive Plan in January 2001. The Incentive Plan is administered by the Compensation Committee of the

Board of Directors (Compensation Committee). The Incentive Plan includes provisions for granting incentive stock options for shares

of Class A stock at a price not less than the fair market value at the date of grant. Nonqualified stock options may be granted at a price

equal to, less than or more than the fair market value of Class A stock on the date the option is granted. Stock options under the

Incentive Plan generally become exercisable ratably over two to five years from the date of grant and must be exercised within 10

years from the date of grant. Our policy is to recognize compensation expense on a straight-line basis over the requisite service period

for the entire award.