Tyson Foods 2009 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2009 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

●

Acquisitions – In October 2008, we acquired three vertically integrated poultry companies in southern Brazil. The

aggregate purchase price was $67 million, of which $4 million of mandatory deferred payments remains to be paid

through fiscal 2011. In addition, we have $15 million of contingent purchase price based on production volumes

anticipated to be paid through fiscal 2011. The joint ventures in China called Shandong Tyson Xinchang Foods

received the necessary government approvals during fiscal 2009. The aggregate purchase price for our 60% equity

interest was $21 million, which excludes $93 million of cash transferred to the joint venture for future capital needs.

●

Proceeds from sale of assets in fiscal 2007 include $40 million received related to the sale of two poultry plants and

related support facilities.

●

Short-term investment was purchased in fiscal 2006 with proceeds from $1.0 billion of senior notes maturing on April

1, 2016 (2016 Notes). The short-term investment was held in an interest bearing account with a trustee. In fiscal 2007,

we used proceeds from sale of the short-term investment to repay our outstanding $750 million 7.25% Notes due

October 1, 2006.

●

Change in restricted cash – In October 2008, Dynamic Fuels received $100 million in proceeds from the sale of Gulf

Opportunity Zone tax-exempt bonds made available by the federal government to the regions affected by Hurricanes

Katrina and Rita in 2005. The cash received from these bonds is restricted and can only be used towards the

construction of the Dynamic Fuels’ facility.

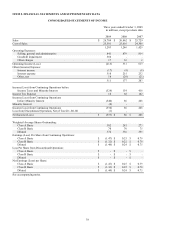

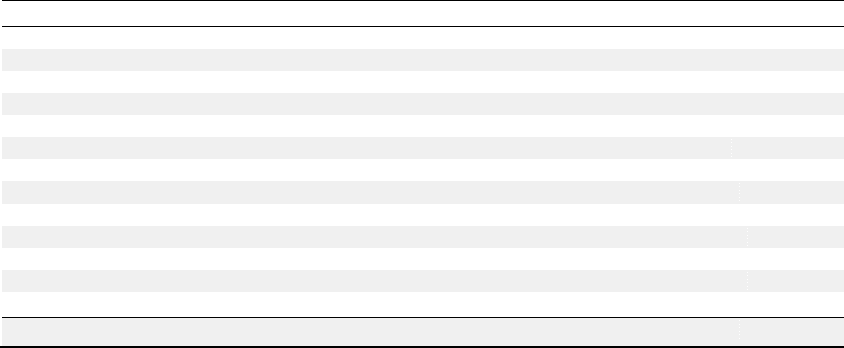

Cash Flows from Financing Activities

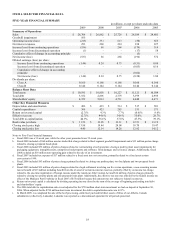

in millions

2009

2008

2007

Net borrowings (payments) on revolving credit facilities

$

15

$

(213

)

$

53

Payments on debt

(380

)

(147

)

(1,263

)

Net proceeds from borrowings

852

449

-

Net proceeds from Class A stock offering

-

274

-

Convertible note hedge transactions

-

(94

)

-

Warrant transactions

-

44

-

Purchases of treasury shares

(19

)

(30

)

(61

)

Dividends

(60

)

(56

)

(56

)

Stock options exercised

1

9

74

Change in negative book cash balances

(65

)

67

9

Change in restricted cash to be used for financing activities

(140

)

-

-

Debt issuance costs

(59

)

-

-

Other, net

5

18

(8

)

Net cash provided by (used for) financing activities

$

150

$

321

$

(1,252

)

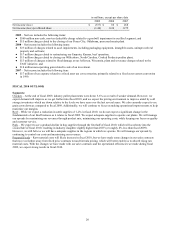

●

Net borrowings (payments) on revolving credit facilities primarily include activity related to the accounts receivable

securitization facility. With the entry into the new revolving credit facility and issuance of the 2014 Notes in March 2009, we

repaid all outstanding borrowings under our accounts receivable securitization facility and terminated the facility.

●

Payments on debt include –

●

In fiscal 2009, we bought back $293 million of notes, which included: $161 million 8.25% Notes due October 2011 (2011

Notes); $94 million 7.95% Notes due February 2010 (2010 Notes); and $38 million 2016 Notes.

●

In fiscal 2008, we bought back $40 million 2016 Notes and repaid the remaining $25 million outstanding Lakeside term

loan.

●

In fiscal 2007, we used proceeds from sale of the short-term investment to repay our outstanding $750 million 7.25%

Notes due October 1, 2006. In addition, we used cash from operations to reduce the amount outstanding under the

Lakeside term loan by $320 million, repay the outstanding $125 million 7.45% Notes due June 1, 2007, and reduce other

borrowings.

●

Net proceeds from borrowings include –

●

In fiscal 2009, we issued $810 million of 2014 Notes. After the original issue discount of $59 million, based on an issue

price of 92.756% of face value, we received net proceeds of $751 million. We used the net proceeds towards the

repayment of our borrowings under our accounts receivable securitization facility and for other general corporate

purposes.

●

In fiscal 2009, Dynamic Fuels received $100 million in proceeds from the sale of Gulf Opportunity Zone tax-exempt

bonds made available by the Federal government to the regions affected by Hurricane Katrina and Rita in 2005. These

floating rate bonds are due October 1, 2033.

●

In fiscal 2008, we issued $458 million 3.25% Convertible Senior Notes due October 15, 2013. Net proceeds were used for

the net cost of the related Convertible Note Hedge and Warrant Transactions, toward the repayment of our borrowings

under the accounts receivable securitization facility, and for other general corporate purposes.