Tyson Foods 2009 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2009 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

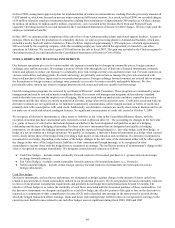

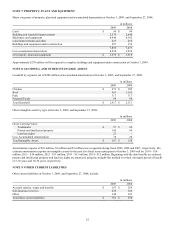

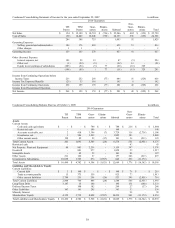

NOTE 7: PROPERTY, PLANT AND EQUIPMENT

Major categories of property, plant and equipment and accumulated depreciation at October 3, 2009, and September 27, 2008:

in millions

2009

2008

Land

$

96

$

89

Building and leasehold improvements

2,570

2,440

Machinery and equipment

4,640

4,382

Land improvements and other

227

210

Buildings and equipment under construction

297

352

7,830

7,473

Less accumulated depreciation

4,254

3,954

Net property, plant and equipment

$

3,576

$

3,519

Approximately $278 million will be required to complete buildings and equipment under construction at October 3, 2009.

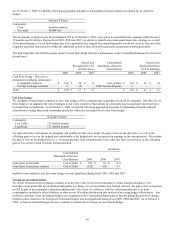

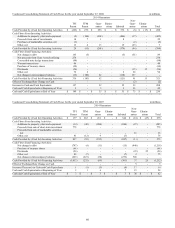

NOTE 8: GOODWILL AND OTHER INTANGIBLE ASSETS

Goodwill by segment, net of $286 million of accumulated amortization at October 3, 2009, and September 27, 2008:

in millions

2009

2008

Chicken

$

973

$

945

Beef

563

1,185

Pork

317

317

Prepared Foods

64

64

Total Goodwill

$

1,917

$

2,511

Other intangible assets by type at October 3, 2009, and September 27, 2008:

in millions

2009

2008

Gross Carrying Value:

Trademarks

$

57

$

62

Patents and intellectual property

145

94

Land use rights

23

-

Less Accumulated Amortization

38

28

Total Intangible Assets

$

187

$

128

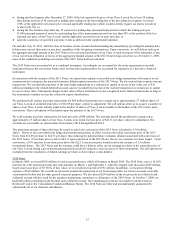

Amortization expense of $10 million, $3 million and $3 million was recognized during fiscal 2009, 2008 and 2007, respectively. We

estimate amortization expense on intangible assets for the next five fiscal years subsequent to October 3, 2009 will be: 2010 - $14

million; 2011 - $14 million; 2012 - $13 million; 2013 - $13 million; 2014 - $12 million. Beginning with the date benefits are realized,

patents and intellectual property and land use rights are amortized using the straight-line method over their estimated period of benefit

of 5-30 years and 10-30 years, respectively.

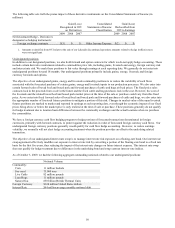

NOTE 9: OTHER CURRENT LIABILITIES

Other current liabilities at October 3, 2009, and September 27, 2008, include:

in millions

2009

2008

Accrued salaries, wages and benefits

$

187

$

259

Self-insurance reserves

230

236

Other

344

383

Total other current liabilities

$

761

$

878