Tyson Foods 2009 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2009 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1: BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Description of Business: Tyson Foods, Inc. (collectively, “Company,” “we,” “us” or “our”), founded in 1935 with world

headquarters in Springdale, Arkansas, is one of the world’s largest processor and marketer of chicken, beef and pork and the

second-largest food production company in the Fortune 500. We produce a wide variety of brand name protein-based and prepared

food products marketed in the United States and approximately 90 countries around the world.

Consolidation: The consolidated financial statements include the accounts of all wholly-owned subsidiaries, as well as

majority-owned subsidiaries for which we have a controlling interest. All significant intercompany accounts and transactions have

been eliminated in consolidation.

We have an investment in a joint venture, Dynamic Fuels LLC (Dynamic Fuels), in which we have a 50 percent ownership interest.

Dynamic Fuels qualifies as a variable interest entity. Effective June 30, 2008, we began consolidating Dynamic Fuels since we are

the primary beneficiary.

Fiscal Year: We utilize a 52- or 53-week accounting period ending on the Saturday closest to September 30. The Company's

accounting cycle resulted in a 53-week year for fiscal year 2009 and a 52-week year for fiscal years 2008 and 2007.

Reclassification: Certain reclassifications were made to prior periods to conform to current presentations in the Consolidated

Financial Statements. The effect of these reclassifications was not significant to the Consolidated Financial Statements.

Discontinued Operation: In June 2008, we executed a letter of intent with XL Foods Inc. (XL Foods) to sell the beef processing,

cattle feed yard and fertilizer assets of three of our Alberta, Canada subsidiaries (collectively, Lakeside), which were part of our Beef

segment. In March 2009, we completed the sale and sold these assets and related inventories. The financial statements report Lakeside

as a discontinued operation. See Note 4: Discontinued Operation in the Notes to Consolidated Financial Statements for further

information.

Cash and Cash Equivalents: Cash equivalents consist of investments in short-term, highly liquid securities having original

maturities of three months or less, which are made as part of our cash management activity. The carrying values of these assets

approximate their fair market values. We primarily utilize a cash management system with a series of separate accounts consisting of

lockbox accounts for receiving cash, concentration accounts where funds are moved to, and several “zero-balance” disbursement

accounts for funding payroll, accounts payable, livestock procurement, grower payments, etc. As a result of our cash management

system, checks issued, but not presented to the banks for payment, may result in negative book cash balances. These negative book

cash balances are included in trade accounts payable and other current liabilities. At October 3, 2009, and September 27, 2008, checks

outstanding in excess of related book cash balances totaled approximately $254 million and $322 million, respectively.

Accounts Receivable: We record accounts receivable at net realizable value. This value includes an appropriate allowance for

estimated uncollectible accounts to reflect any loss anticipated on the accounts receivable balances and charged to the provision for

doubtful accounts. We calculate this allowance based on our history of write-offs, level of past due accounts and relationships with

and economic status of our customers. At October 3, 2009, and September 27, 2008, our allowance for uncollectible accounts was

$33 million and $12 million, respectively. We generally do not have collateral for our receivables, but we do periodically evaluate the

credit worthiness of our customers.

Inventories: Processed products, livestock and supplies and other are valued at the lower of cost or market. Cost includes purchased

raw materials, live purchase costs, growout costs (primarily feed, contract grower pay and catch and haul costs), labor and

manufacturing and production overhead, which are related to the purchase and production of inventories.

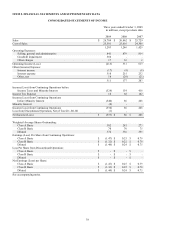

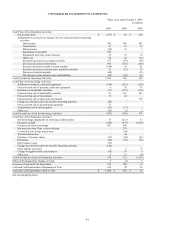

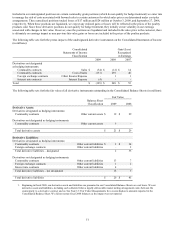

in millions

2009

2008

Processed products:

Weighted-average method – chicken and prepared foods

$

629

$

920

First-in, first-out method – beef and pork

414

571

Livestock – first-in, first-out method

631

701

Supplies and other – weighted-average method

335

346

Total inventory, net

$

2,009

$

2,538