Tyson Foods 2009 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2009 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

Credit Ratings

2016 Notes

On September 4, 2008, Standard & Poor’s (S&P) downgraded the credit rating from “BBB-” to “BB.” This downgrade increased the

interest rate on the 2016 Notes from 6.85% to 7.35%, effective beginning with the six-month interest payment due October 1, 2008.

On November 13, 2008, Moody’s Investors Services, Inc. (Moody’s) downgraded the credit rating from “Ba1” to “Ba3.” This

downgrade increased the interest rate on the 2016 Notes from 7.35% to 7.85%, effective beginning with the six-month interest

payment due April 1, 2009.

S&P currently rates the 2016 Notes “BB.” Moody’s currently rates this debt “Ba3.” A further one-notch downgrade by either ratings

agency would increase the interest rates on the 2016 Notes by an additional 0.25%.

Revolving Credit Facility

S&P’s corporate credit rating for Tyson Foods, Inc. is “BB.” Moody’s corporate credit rating for Tyson Foods, Inc. is “Ba3.” If S&P

were to downgrade our corporate credit rating to “B+” or lower or Moody’s were to downgrade our corporate credit rating to “B1” or

lower, our letter of credit fees would increase by an additional 0.25%.

Debt Covenants

Our revolving credit facility contains affirmative and negative covenants that, among other things, may limit or restrict our ability to:

create liens and encumbrances; incur debt; merge, dissolve, liquidate or consolidate; make acquisitions and investments; dispose of or

transfer assets; pay dividends or make other payments in respect to our capital stock; amend material documents; change the nature of

our business; make certain payments of debt; engage in certain transactions with affiliates; and enter into sale/leaseback or hedging

transactions, in each case, subject to certain qualifications and exceptions. If availability under this facility is less than the greater of

15% of the commitments and $150 million, we will be required to maintain a minimum fixed charge coverage ratio.

Our 2014 Notes also contain affirmative and negative covenants that, among other things, may limit or restrict our ability to: incur

additional debt and issue preferred stock; make certain investments and restricted payments; create liens; create restrictions on

distributions from restricted subsidiaries; engage in specified sales of assets and subsidiary stock; enter into transactions with

affiliates; enter new lines of business; engage in consolidation, mergers and acquisitions; and engage in certain sale/leaseback

transactions.

OFF-BALANCE SHEET ARRANGEMENTS

We do not have any off-balance sheet arrangements material to our financial position or results of operations. The off-balance sheet

arrangements we have are guarantees of debt of outside third parties, including a lease and grower loans, and residual value

guarantees covering certain operating leases for various types of equipment. See Note 10, “Commitments” of the Notes to

Consolidated Financial Statements for further discussion.

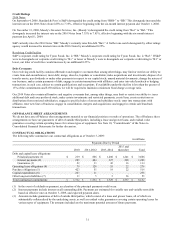

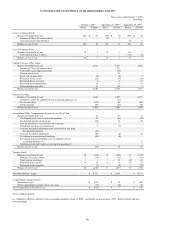

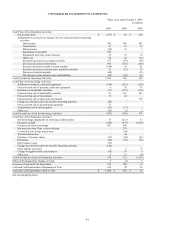

CONTRACTUAL OBLIGATIONS

The following table summarizes our contractual obligations as of October 3, 2009:

in millions

Payments Due by Period

2010

2011-2012

2013-2014

2015 and

thereafter

Total

Debt and capital lease obligations:

Principal payments (1)

$

219

$

866

$

1,280

$

1,241

$

3,606

Interest payments (2)

289

444

327

220

1,280

Guarantees (3)

22

33

43

16

114

Operating lease obligations (4)

79

120

55

22

276

Purchase obligations (5)

423

55

19

22

519

Capital expenditures (6)

267

11

-

-

278

Other long-term liabilities (7)

13

5

5

36

59

Total contractual commitments

$

1,312

$

1,534

$

1,729

$

1,557

$

6,132

(1)

In the event of a default on payment, acceleration of the principal payments could occur.

(2)

Interest payments include interest on all outstanding debt. Payments are estimated for variable rate and variable term debt

based on effective rates at October 3, 2009, and expected payment dates.

(3)

Amounts include guarantees of debt of outside third parties, which consist of a lease and grower loans, all of which are

substantially collateralized by the underlying assets, as well as residual value guarantees covering certain operating leases for

various types of equipment. The amounts included are the maximum potential amount of future payments.