Tyson Foods 2009 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2009 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.19

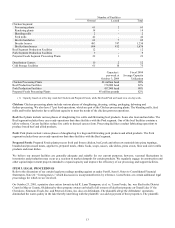

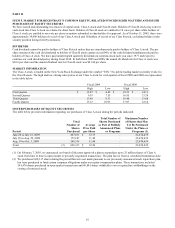

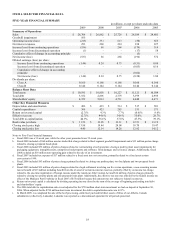

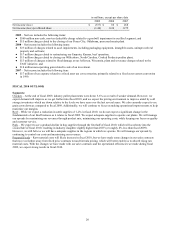

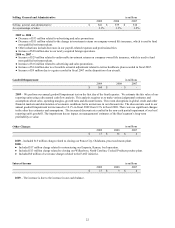

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

DESCRIPTION OF THE COMPANY

We are the world’s largest meat protein company and the second-largest food production company in the Fortune 500 with one of the

most recognized brand names in the food industry. We produce, distribute and market chicken, beef, pork, prepared foods and related

allied products. Our operations are conducted in four segments: Chicken, Beef, Pork and Prepared Foods. Some of the key factors

influencing our business are customer demand for our products; the ability to maintain and grow relationships with customers and

introduce new and innovative products to the marketplace; accessibility of international markets; market prices for our products; the

cost of live cattle and hogs, raw materials and grain; and operating efficiencies of our facilities.

OVERVIEW

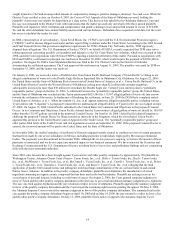

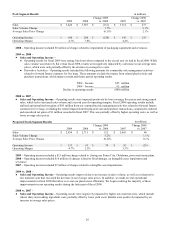

●

Chicken Segment – Fiscal 2009 operating results were negatively impacted in the first half of fiscal 2009 by high grain

costs and net losses on our commodity risk management activities related to grain and energy purchases. The second half of

fiscal 2009 benefited as we had worked through the majority of our long grain positions, had more stable grain prices and

made several operational improvements. Operating margins in the first half of fiscal 2009 were negative 7.2%, while the

second half improved to positive 3.5%.

●

Beef Segment – Fiscal 2009 operating loss was $346 million, which included a $560 million non-cash goodwill

impairment. Excluding the goodwill impairment charge, operating results doubled as compared to fiscal 2008. We

sustained our operational improvements made in fiscal 2008 and continue to have strong performance, which shows in our

fiscal 2009 operating results.

●

Beef Goodwill Impairment – We perform our annual goodwill impairment test on the first day of the fourth

quarter. We estimate the fair value of our reporting units using a discounted cash flow analysis. This analysis requires

us to make various judgmental estimates and assumptions about sales, operating margins, growth rates and discount

factors. The recent disruptions in global credit and other financial markets and deterioration of economic conditions led

to an increase in our discount rate. The discount rate used in our annual goodwill impairment test increased to 10.1% in

fiscal 2009 from 9.3% in fiscal 2008. There were no significant changes in the other key estimates and

assumptions. The increased discount rate resulted in the non-cash partial impairment of our beef reporting unit's

goodwill. The impairment has no impact on management’s estimates of the Beef segment’s long-term profitability or

value.

●

Pork Segment – While our operating income was down as compared to the record year we had in fiscal 2008, we still had

solid operating earnings of $160 million, or 4.7%, with strong demand for our products and adequate supplies of hogs.

●

Prepared Foods Segment – In fiscal 2009, we had improvements in our sales volumes, which led to operating margins of

4.7%. In addition, we made several operational improvements that allow us to run our plants more efficiently.

●

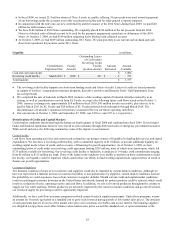

Liquidity – In March 2009, we replaced our then existing $1.0 billion revolving credit facility set to expire in fiscal 2010

with a new $1.0 billion revolving credit facility which expires in March 2012. In addition, we issued $810 million of senior

notes. In conjunction with these transactions, we paid down and terminated our accounts receivable securitization

agreement. These transactions, as well as a significant decrease in our working capital needs, helped to strengthen our

liquidity position. At October 3, 2009, we had nearly $1.2 billion in total cash (including restricted cash), as well as $733

million available for borrowing under our revolving credit facility.

●

Acquisitions –

●

In October 2008, we completed the acquisition of three vertically-integrated poultry companies in southern Brazil.

●

In August 2009, we acquired 60% equity interest in a joint venture with a vertically-integrated poultry operation in

eastern China.

●

In March 2009, we completed the sale of the beef processing, cattle feed yard and fertilizer assets of three of our Alberta,

Canada subsidiaries (collectively, Lakeside) to XL Foods Inc., a Canadian-owned beef processing business, and an entity

affiliated with XL Foods. We received total consideration of $145 million, which included cash received at closing,

collateralized notes receivable and XL Foods Preferred Stock.

●

Our accounting cycle resulted in a 53-week year for fiscal 2009 and a 52-week year for both fiscal 2008 and 2007.