Tyson Foods 2009 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2009 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

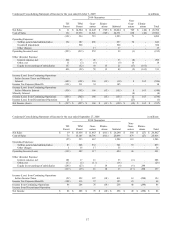

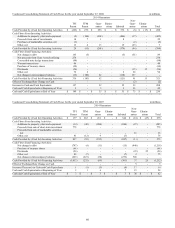

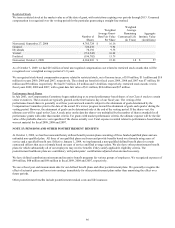

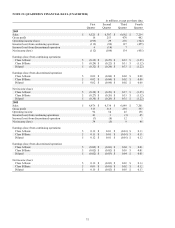

Shares Under

Option

Weighted

Average

Exercise Price

Per Share

Weighted

Average

Remaining

Contractual Life

(in Years)

Aggregate

Intrinsic Value

(in millions)

Outstanding, September 27, 2008

16,906,014

$

14.38

Exercised

(72,590

)

8.63

Canceled

(1,495,506

)

14.47

Granted

3,255,926

4.90

Outstanding, October 3, 2009

18,593,844

12.73

6.2

$

237

Exercisable, October 3, 2009

10,050,940

$

13.75

4.5

$

138

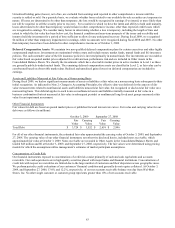

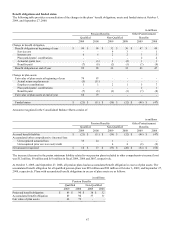

We grant stock options once a year. The grant-date fair value of options granted in fiscal 2009, 2008 and 2007 was $1.29, $5.22 and

$5.85, respectively. The fair value of each option grant is established on the date of grant using a binomial lattice method for grants

awarded after October 1, 2005, and the Black-Scholes option-pricing model for grants awarded before October 1, 2005. The change

to the binomial lattice method was made to better reflect the exercise behavior of top management. We use historical volatility for a

period of time comparable to the expected life of the option to determine volatility assumptions. Expected life is calculated based on

the contractual term of each grant and takes into account the historical exercise and termination behavior of participants. Risk-free

interest rates are based on the five-year Treasury bond rate. Assumptions as of the grant date used in the fair value calculation of each

year’s grants are outlined in the following table.

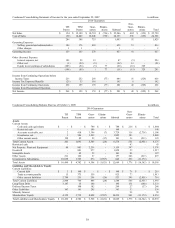

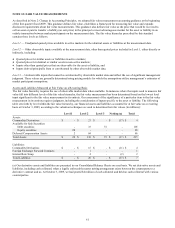

2009

2008

2007

Expected life

5.3 years

5.8 years

5.4 years

Risk-free interest rate

2.3

%

3.7

%

4.6

%

Expected volatility

34.6

%

30.9

%

33.7

%

Expected dividend yield

3.3

%

1.1

%

1.0

%

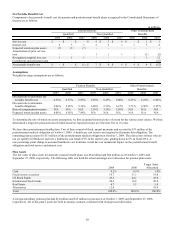

We recognized stock-based compensation expense related to stock options, net of income taxes, of $9 million, $12 million and $11

million, respectively, during fiscal years 2009, 2008 and 2007, with a $6 million, $7 million and $6 million related tax benefit. We

had 2.4 million, 2.5 million and 1.9 million options vest in fiscal years 2009, 2008 and 2007, respectively, with a fair value of $15

million, $15 million and $9 million, respectively.

In fiscal years 2009, 2008 and 2007, we received cash of $1 million, $9 million and $59 million, respectively, for the exercise of stock

options. Shares are issued from treasury for stock option exercises. The related tax benefit realized from stock options exercised

during fiscal years 2009, 2008 and 2007, was $0, $1 million and $12 million, respectively. The total intrinsic value of options

exercised in fiscal years 2009, 2008 and 2007, was $0, $3 million and $31 million, respectively. Cash flows resulting from tax

deductions in excess of the compensation cost of those options (excess tax deductions) are classified as financing cash flows. We

realized $0, $0 and $9 million, respectively, in excess tax deductions during fiscal years 2009, 2008 and 2007, respectively. As of

October 3, 2009, we had $29 million of total unrecognized compensation cost related to stock option plans that will be recognized

over a weighted average period of 2.7 years.