Tyson Foods 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

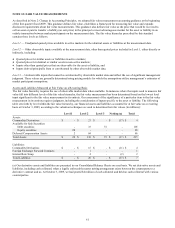

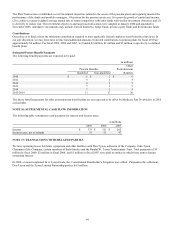

NOTE 12: FAIR VALUE MEASUREMENTS

As described in Note 2: Change in Accounting Principles, we adopted fair value measurement accounting guidance at the beginning

of the first quarter fiscal 2009. This guidance defines fair value, establishes a framework for measuring fair value and expands

disclosure requirements about fair value measurements. This guidance also defines fair value as the price that would be received to

sell an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an

orderly transaction between market participants on the measurement date. The fair value hierarchy prescribed by this standard

contains three levels as follows:

Level 1 — Unadjusted quoted prices available in active markets for the identical assets or liabilities at the measurement date.

Level 2 — Other observable inputs available at the measurement date, other than quoted prices included in Level 1, either directly or

indirectly, including:

●

Quoted prices for similar assets or liabilities in active markets;

●

Quoted prices for identical or similar assets in non-active markets;

●

Inputs other than quoted prices that are observable for the asset or liability; and

●

Inputs derived principally from or corroborated by other observable market data.

Level 3 — Unobservable inputs that cannot be corroborated by observable market data and reflect the use of significant management

judgment. These values are generally determined using pricing models for which the assumptions utilize management’s estimates of

market participant assumptions.

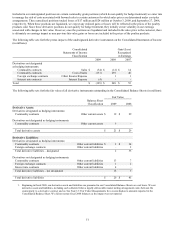

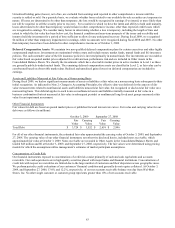

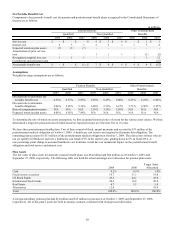

Assets and Liabilities Measured at Fair Value on a Recurring Basis

The fair value hierarchy requires the use of observable market data when available. In instances where the inputs used to measure fair

value fall into different levels of the fair value hierarchy, the fair value measurement has been determined based on the lowest level

input significant to the fair value measurement in its entirety. Our assessment of the significance of a particular item to the fair value

measurement in its entirety requires judgment, including the consideration of inputs specific to the asset or liability. The following

table sets forth by level within the fair value hierarchy, our financial assets and liabilities accounted for at fair value on a recurring

basis at October 3, 2009, according to the valuation techniques we used to determine their fair values (in millions):

Level 1

Level 2

Level 3

Netting (a)

Total

Assets:

Commodity Derivatives

$

-

$

21

$

-

$

(17

)

$

4

Available for Sale Securities:

Debt securities

-

33

72

-

105

Equity securities

20

-

-

-

20

Deferred Compensation Assets

2

84

-

-

86

Total Assets

$

22

$

138

$

72

$

(17

)

$

215

Liabilities:

Commodity Derivatives

$

-

$

15

$

-

$

(11

)

$

4

Foreign Exchange Forward Contracts

-

1

-

-

1

Interest Rate Swap

-

4

-

(2

)

2

Total Liabilities

$

-

$

20

$

-

$

(13

)

$

7

(a) Our derivative assets and liabilities are presented in our Consolidated Balance Sheets on a net basis. We net derivative assets and

liabilities, including cash collateral, when a legally enforceable master netting arrangement exists between the counterparty to a

derivative contract and us. At October 3, 2009, we had posted $4 million of cash collateral and held no cash collateral with various

counterparties.