Tyson Foods 2009 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2009 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.45

Use of Estimates: The consolidated financial statements are prepared in conformity with accounting principles generally accepted in

the United States, which require us to make estimates and assumptions that affect the amounts reported in the consolidated financial

statements and accompanying notes. Actual results could differ from those estimates.

Recently Issued Accounting Pronouncements: In December 2007, the Financial Accounting Standards Board (FASB) issued

guidance to establish accounting and reporting standards for a noncontrolling interest in a subsidiary and for the deconsolidation of a

subsidiary. This guidance clarifies that a noncontrolling interest in a subsidiary is an ownership interest in the consolidated entity and

may be reported as equity in the consolidated financial statements, rather than in the liability or mezzanine section between liabilities

and equity. This guidance also requires consolidated net income be reported at amounts that include the amounts attributable to both

the parent and the noncontrolling interest. This statement is not expected to have a material impact on our consolidated financial

statements; however, certain financial statement presentation changes and additional required disclosures will be made. The guidance

is effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2008; therefore, we will

adopt at the beginning of fiscal 2010.

In December 2007, the FASB issued guidance establishing principles and requirements for how an acquirer in a business

combination: 1) recognizes and measures in its financial statements identifiable assets acquired, liabilities assumed, and any

noncontrolling interest in the acquiree; 2) recognizes and measures goodwill acquired in a business combination or a gain from a

bargain purchase; and 3) determines what information to disclose to enable users of the financial statements to evaluate the nature and

financial effects of a business combination. This guidance is effective for business combinations for which the acquisition date is on

or after the beginning of the first annual reporting period beginning on or after December 15, 2008; therefore, we will adopt this

guidance for any business combinations entered into beginning in fiscal 2010.

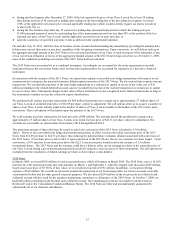

In May 2008, the FASB issued guidance which specifies issuers of convertible debt instruments that may be settled in cash upon

conversion (including partial cash settlement) should separately account for the liability and equity components in a manner that will

reflect the entity’s nonconvertible debt borrowing rate when interest cost is recognized in subsequent periods. The amount allocated

to the equity component represents a discount to the debt, which is amortized into interest expense using the effective interest method

over the life of the debt. This guidance is effective for financial statements issued for fiscal years beginning after December 15, 2008,

and interim periods within those fiscal years. Early adoption is not permitted. We will adopt the provisions of this guidance beginning

in the first quarter of fiscal 2010. The provisions are required to be applied retrospectively to all periods presented. Upon retrospective

adoption, our effective interest rate on our 3.25% Convertible Senior Notes due 2013 will be 8.26%, which would result in the

recognition of a $92 million discount to these notes with the offsetting after tax amount of $56 million recorded to capital in excess of

par value. This discount will be accreted over the five-year term of the convertible notes at the effective interest rate, which will not

materially impact fiscal 2008 interest expense, but will result in an estimated $17 million non-cash increase to our reported fiscal year

2009 interest expense.

In December 2008, the FASB issued guidance requiring additional disclosures about assets held in an employer’s defined benefit

pension or other postretirement plan. This guidance is effective for fiscal years ending after December 15, 2009, with early adoption

permitted. We will adopt the disclosure requirements beginning with our fiscal 2010 annual report.

In June 2009, the FASB issued guidance removing the concept of a qualifying special-purpose entity (QSPE). This guidance also

clarifies the requirements for isolation and limitations on portions of financial assets eligible for sale accounting. This guidance is

effective for fiscal years beginning after November 15, 2009. Accordingly, we will adopt this guidance in fiscal year 2011. We are in

process of evaluating the potential impacts.

In June 2009, the FASB issued guidance requiring an analysis to determine whether a variable interest gives the entity a controlling

financial interest in a variable interest entity. This guidance requires an ongoing reassessment and eliminates the quantitative

approach previously required for determining whether an entity is the primary beneficiary. This guidance is effective for fiscal years

beginning after November 15, 2009. Accordingly, we will adopt this guidance in fiscal year 2011. We are in process of evaluating the

potential impacts.

Subsequent Events: We have evaluated subsequent events through the time of filing on November 23, 2009, which represents the

date the Consolidated Financial Statements were issued.

NOTE 2: CHANGE IN ACCOUNTING PRINCIPLES

In September 2006, the FASB issued guidance for using fair value to measure assets and liabilities. This guidance also requires

expanded information about the extent to which companies measure assets and liabilities at fair value, the information used to

measure fair value and the effect of fair value measurements on earnings. This guidance applies whenever other standards require (or

permit)