Tyson Foods 2009 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2009 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

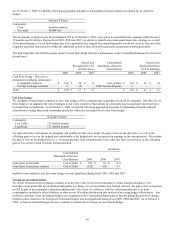

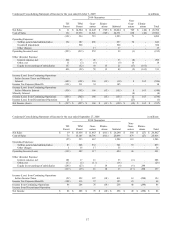

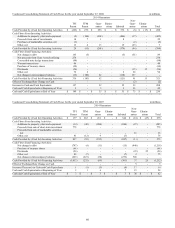

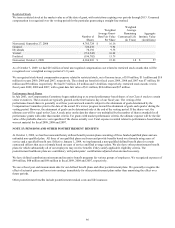

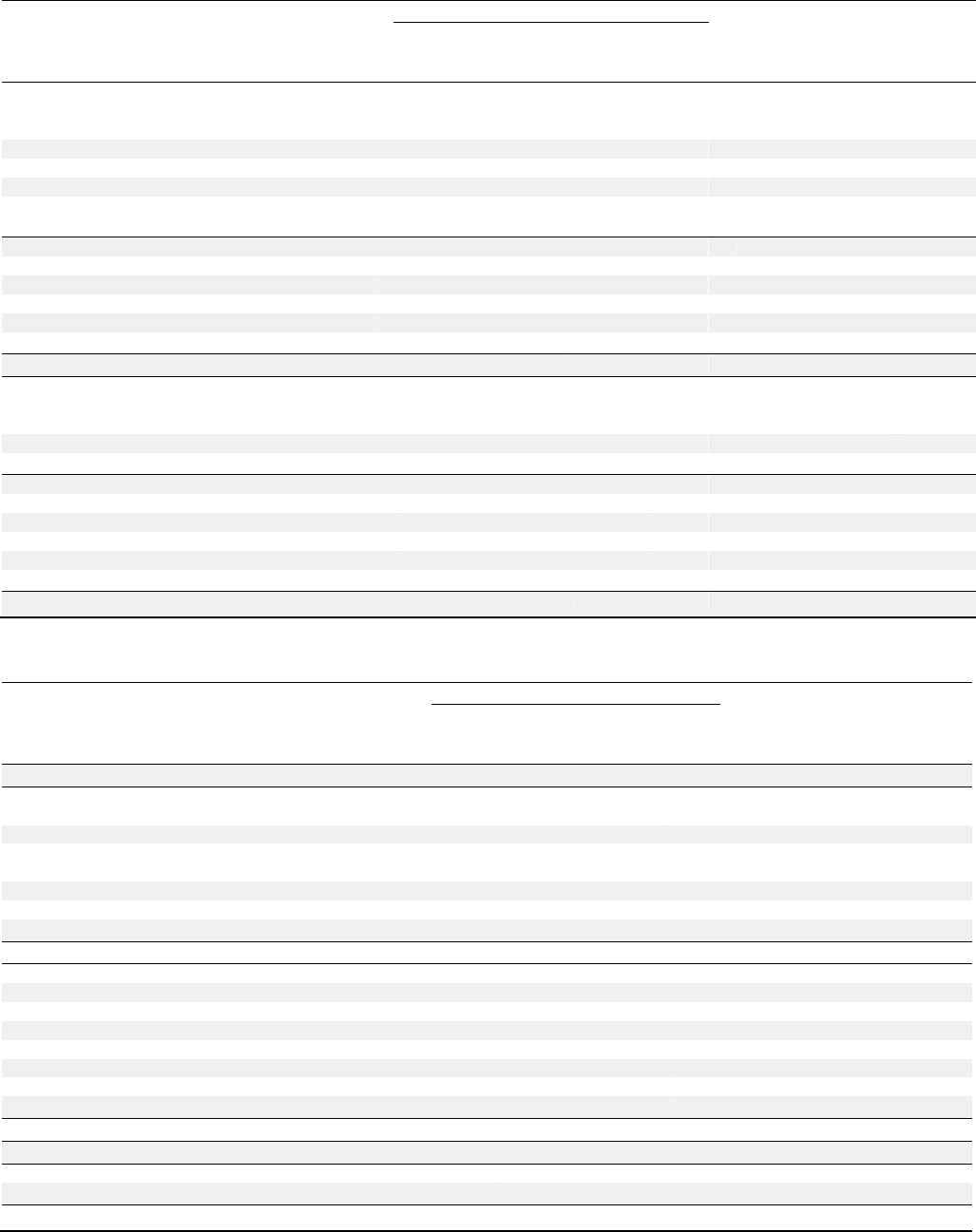

Condensed Consolidating Balance Sheet as of September 27, 2008

in millions

2014 Guarantors

TFI

Parent

TFM

Parent

Guar-

antors

Elimin-

ations

Subtotal

Non-

Guar-

antors

Elimin-

ations

Total

Assets

Current Assets:

Cash and cash equivalents

$

140

$

-

$

35

$

-

$

35

$

75

$

-

$

250

Accounts receivable, net

1

122

3,614

-

3,736

113

(2,579

)

1,271

Inventories, net

1

724

1,640

-

2,364

173

-

2,538

Other current assets

123

55

24

(12

)

67

72

(119

)

143

Assets of discontinued operation held

for sale

-

-

-

-

-

159

-

159

Total Current Assets

265

901

5,313

(12

)

6,202

592

(2,698

)

4,361

Net Property, Plant and Equipment

43

960

2,371

-

3,331

145

-

3,519

Goodwill

-

1,502

965

-

2,467

44

-

2,511

Intangible Assets

-

47

64

-

111

17

-

128

Other Assets

132

91

55

-

146

284

(231

)

331

Investment in Subsidiaries

10,293

1,789

654

(1,639

)

804

282

(11,379

)

-

Total Assets

$

10,733

$

5,290

$

9,422

$

(1,651

)

$

13,061

$

1,364

$

(14,308

)

$

10,850

Liabilities and Shareholders’ Equity

Current Liabilities:

Current debt

$

8

$

-

$

-

$

-

$

-

$

-

$

-

$

8

Trade accounts payable

108

486

559

-

1,045

64

-

1,217

Other current liabilities

2,804

201

282

(12

)

471

301

(2,698

)

878

Total Current Liabilities

2,920

687

841

(12

)

1,516

365

(2,698

)

2,103

Long-Term Debt

2,632

249

180

-

429

7

(180

)

2,888

Deferred Income Taxes

-

129

190

-

319

23

(51

)

291

Other Liabilities

167

137

190

-

327

31

-

525

Minority Interest

-

-

-

-

-

29

-

29

Shareholders’ Equity

5,014

4,088

8,021

(1,639

)

10,470

909

(11,379

)

5,014

Total Liabilities and Shareholders’ Equity

$

10,733

$

5,290

$

9,422

$

(1,651

)

$

13,061

$

1,364

$

(14,308

)

$

10,850

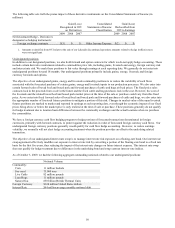

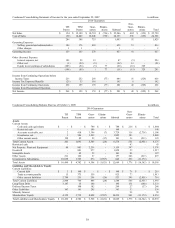

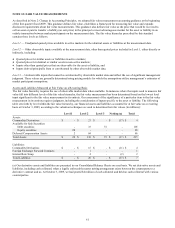

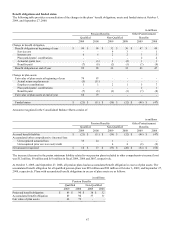

Condensed Consolidating Statement of Cash Flows for the year ended October 3, 2009

in millions

2014 Guarantors

TFI

Parent

TFM

Parent

Guar-

antors

Elimin-

ations

Subtotal

Non-

Guar-

antors

Elimin-

ations

Total

Cash Provided by (Used for) Operating Activities

$

(617

)

$

507

$

1,034

$

-

$

1,541

$

126

$

(25

)

$

1,025

Cash Flows From Investing Activities:

Additions to property, plant and equipment

-

(56

)

(211

)

-

(267

)

(101

)

-

(368

)

Change in restricted cash-investing

-

-

-

-

-

(43

)

-

(43

)

Proceeds from sale of marketable securities,

net

-

-

-

-

-

19

-

19

Proceeds from sale of discontinued operation

-

-

-

-

-

75

-

75

Acquisitions, net of cash acquired

-

-

(13

)

-

(13

)

(80

)

-

(93

)

Other, net

(37

)

1

12

-

13

7

-

(17

)

Cash Used for Investing Activities

(37

)

(55

)

(212

)

-

(267

)

(123

)

-

(427

)

Cash Flows from Financing Activities:

Net change in debt

545

(94

)

-

-

(94

)

36

-

487

Debt issuance costs

(58

)

-

-

-

-

(1

)

-

(59

)

Change in restricted cash-financing

-

-

(140

)

-

(140

)

-

-

(140

)

Purchase of treasury shares

(19

)

-

-

-

-

-

-

(19

)

Dividends

(60

)

-

-

-

-

(25

)

25

(60

)

Other, net

-

-

(52

)

-

(52

)

(7

)

-

(59

)

Net change in intercompany balances

106

(358

)

123

-

(235

)

129

-

-

Cash Provided by (Used for) Financing Activities

514

(452

)

(69

)

-

(521

)

132

25

150

Effect of Exchange Rate Change on Cash

-

-

-

-

-

6

-

6

Increase (Decrease) in Cash and Cash Equivalents

(140

)

-

753

-

753

141

-

754

Cash and Cash Equivalents at Beginning of Year

140

-

35

-

35

75

-

250

Cash and Cash Equivalents at End of Year

$

-

$

-

$

788

$

-

$

788

$

216

$

-

$

1,004