Tyson Foods 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

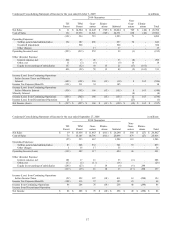

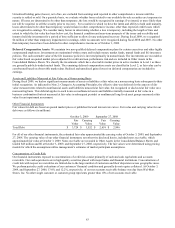

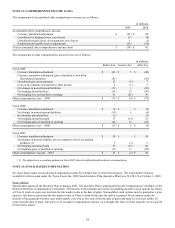

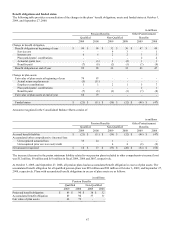

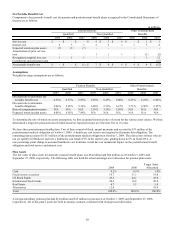

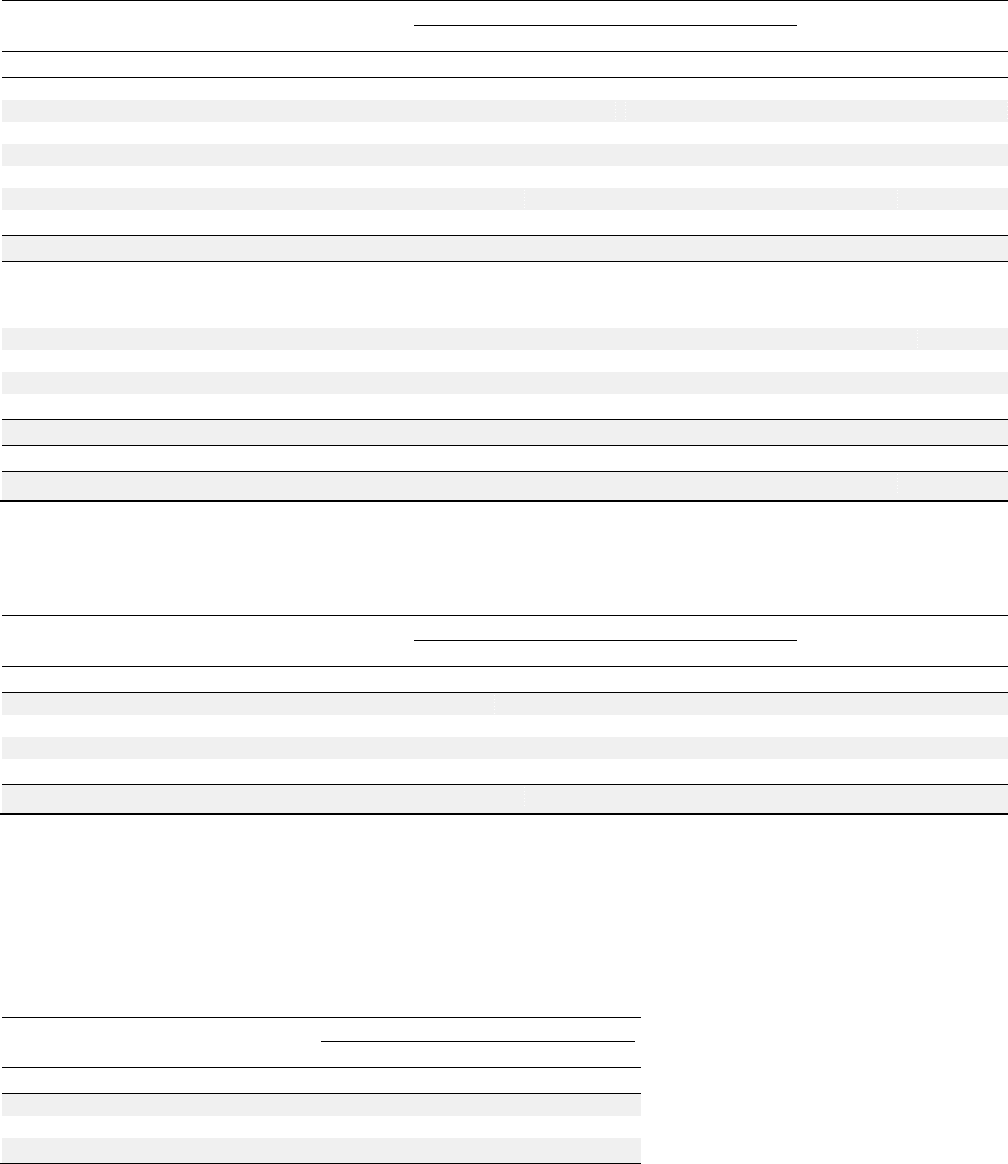

Benefit obligations and funded status

The following table provides a reconciliation of the changes in the plans’ benefit obligations, assets and funded status at October 3,

2009, and September 27, 2008:

in millions

Pension Benefits

Other Postretirement

Qualified

Non-Qualified

Benefits

2009

2008

2009

2008

2009

2008

Change in benefit obligation

Benefit obligation at beginning of year

$

90

$

98

$

32

$

30

$

47

$

49

Service cost

-

-

4

3

-

1

Interest cost

6

6

2

2

3

3

Plan participants’ contributions

-

-

-

-

2

2

Actuarial (gain) loss

-

(6

)

2

(2

)

1

1

Benefits paid

(7

)

(8

)

(2

)

(1

)

(7

)

(9

)

Benefit obligation at end of year

89

90

38

32

46

47

Change in plan assets

Fair value of plan assets at beginning of year

79

97

-

-

-

-

Actual return on plan assets

(5

)

(11

)

-

-

-

-

Employer contributions

1

1

2

1

5

7

Plan participants’ contributions

-

-

-

-

2

1

Benefits paid

(7

)

(8

)

(2

)

(1

)

(7

)

(8

)

Fair value of plan assets at end of year

68

79

-

-

-

-

Funded status

$

(21

)

$

(11

)

$

(38

)

$

(32

)

$

(46

)

$

(47

)

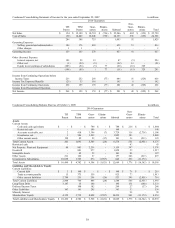

Amounts recognized in the Consolidated Balance Sheets consist of:

in millions

Pension Benefits

Other Postretirement

Qualified

Non-Qualified

Benefits

2009

2008

2009

2008

2009

2008

Accrued benefit liability

$

(21

)

$

(11

)

$

(38

)

$

(32

)

$

(46

)

$

(47

)

Accumulated other comprehensive (income)/loss:

Unrecognized actuarial loss

35

24

1

-

-

-

Unrecognized prior service (cost)/credit

-

-

4

4

(8

)

(9

)

Net amount recognized

$

14

$

13

$

(33

)

$

(28

)

$

(54

)

$

(56

)

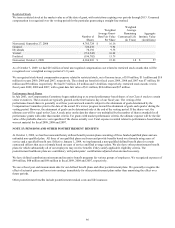

The increase (decrease) in the pretax minimum liability related to our pension plans included in other comprehensive income (loss)

was $12 million, $9 million and $(9) million in fiscal 2009, 2008 and 2007, respectively.

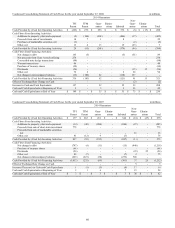

At October 3, 2009, and September 27, 2008, all pension plans had an accumulated benefit obligation in excess of plan assets. The

accumulated benefit obligation for all qualified pension plans was $89 million and $90 million at October 3, 2009, and September 27,

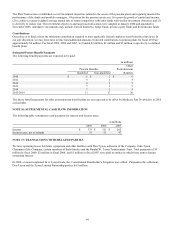

2008, respectively. Plans with accumulated benefit obligations in excess of plan assets are as follows:

in millions

Pension Benefits

Qualified

Non-Qualified

2009

2008

2009

2008

Projected benefit obligation

$

89

$

90

$

38

$

32

Accumulated benefit obligation

89

90

37

31

Fair value of plan assets

68

79

-

-