Tyson Foods 2009 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2009 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.43

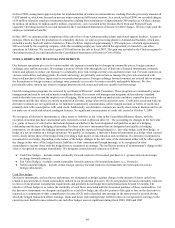

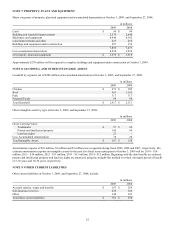

Property, Plant and Equipment: Property, plant and equipment are stated at cost and primarily depreciated on a straight-line

method, using estimated lives for buildings and leasehold improvements of 10 to 33 years, machinery and equipment of three to 12

years and land improvements and other of three to 20 years. Major repairs and maintenance costs that significantly extend the useful

life of the related assets are capitalized. Normal repairs and maintenance costs are charged to operations.

We review the carrying value of long-lived assets at each balance sheet date if indication of impairment exists. Recoverability is

assessed using undiscounted cash flows based on historical results and current projections of earnings before interest and taxes. We

measure impairment as the excess of carrying cost over the fair value of an asset. The fair value of an asset is measured using

discounted cash flows of future operating results based on a discount rate that corresponds to our cost of capital.

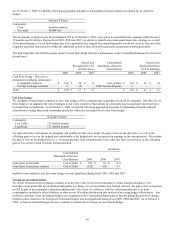

Goodwill and Other Intangible Assets: Goodwill and indefinite life intangible assets are initially recorded at fair value and not

amortized, but are reviewed for impairment at least annually or more frequently if impairment indicators arise. Our goodwill is

allocated by reporting unit, and we follow a two-step process to evaluate if a potential impairment exists. The first step is to identify if

a potential impairment exists by comparing the fair value of a reporting unit with its carrying amount, including goodwill. If the fair

value of a reporting unit exceeds its carrying amount, goodwill of the reporting unit is not considered to have a potential impairment

and the second step of the impairment test is not necessary. However, if the carrying amount of a reporting unit exceeds its fair value,

the second step is performed to determine if goodwill is impaired and to measure the amount of impairment loss to recognize, if any.

The second step compares the implied fair value of goodwill with the carrying amount of goodwill. If the implied fair value of

goodwill exceeds the carrying amount, then goodwill is not considered impaired. However, if the carrying amount of goodwill

exceeds the implied fair value, an impairment loss is recognized in an amount equal to that excess. The implied fair value of goodwill

is determined in the same manner as the amount of goodwill recognized in a business combination (i.e., the fair value of the reporting

unit is allocated to all the assets and liabilities, including any unrecognized intangible assets, as if the reporting unit had been acquired

in a business combination and the fair value of the reporting unit was the purchase price paid to acquire the reporting unit). We have

elected to make the first day of the fourth quarter the annual impairment assessment date for goodwill and other indefinite life

intangible assets.

We have estimated the fair value of our reporting units using a discounted cash flow analysis. This analysis requires us to make

various judgmental estimates and assumptions about sales, operating margins, growth rates and discount factors. The recent

disruptions in global credit and other financial markets and deterioration of economic conditions led to an increase in our discount

rate used in the 2009 annual goodwill impairment analysis. There were no significant changes in the other key assumptions and

estimates. As a result of the increased discount rate, we failed the first step of the 2009 goodwill impairment analysis for our Beef

reporting unit and performed the second step. The second step resulted in a $560 million non-cash partial impairment of the Beef

reporting unit's goodwill. During fiscal 2009, 2008 and 2007, all of our reporting units passed the first step of the goodwill

impairment analysis, with the exception of the Beef reporting unit during fiscal 2009.

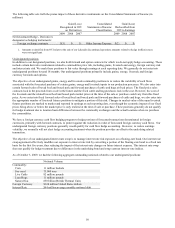

While estimating the fair value of our Beef and Chicken reporting units, we assumed operating margins in future years in excess of

the annual margins realized in the most recent year. The fair value estimates for these reporting units assume normalized operating

margin assumptions and improved operating efficiencies based on long-term expectations and operating margins historically realized

in the beef and chicken industries. Some of the inherent estimates and assumptions used in determining fair value of the reporting

units are outside the control of management, including interest rates, cost of capital, tax rates, and our credit ratings. While we believe

we have made reasonable estimates and assumptions to calculate the fair value of the reporting units, it is possible a material change

could occur. If our actual results are not consistent with our estimates and assumptions used to calculate fair value, we may be

required to perform the second step in future years, which could result in additional material impairments of our goodwill.

For our other indefinite life intangible assets, if the carrying value of the intangible asset exceeds its fair value, an impairment loss is

recognized in an amount equal to that excess. The fair value of trademarks is determined using a royalty rate method based on

expected revenues by trademark.

Investments: We have investments in joint ventures and other entities. We use the cost method of accounting where our voting

interests are less than 20 percent and the equity method of accounting where our voting interests are in excess of 20 percent, but we

do not have a controlling interest or a variable interest in which we are the primary beneficiary. Investments in joint ventures and

other entities are reported in the Consolidated Balance Sheets in Other Assets.

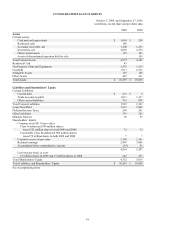

We have investments in marketable debt securities. As of October 3, 2009, and September 27, 2008, $81 million and $94 million,

respectively, were classified in Other Assets in the Consolidated Balance Sheets, with maturities ranging up to 47 years. We have

determined all our marketable debt securities are available-for-sale investments. These investments are reported at fair value based on

quoted market prices as of the balance sheet date, with unrealized gains and losses, net of tax, recorded in other comprehensive

income. The amortized cost of debt securities is adjusted for amortization of premiums and accretion of discounts to maturity. Such