Tyson Foods 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

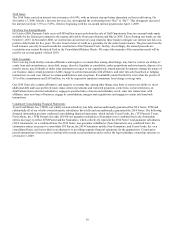

●

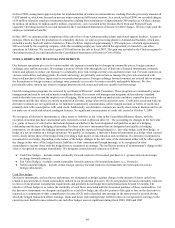

during any fiscal quarter after December 27, 2008, if the last reported sale price of our Class A stock for at least 20 trading

days during a period of 30 consecutive trading days ending on the last trading day of the preceding fiscal quarter is at least

130% of the applicable conversion price on

each applicable trading day (which would currently require our shares to trade at

or above $21.96); or

●

during the five business days after any 10 consecutive trading days (measurement period) in which the trading price per

$1,000 principal amount of notes for each trading day of the measurement period was less than 98% of the product of the last

reported sale price of our Class A stock and the applicable conversion rate on each such day; or

●

upon the occurrence of specified corporate events as defined in the supplemental indenture.

On and after July 15, 2013, until the close of business on the second scheduled trading day immediately preceding the maturity date,

holders may convert their notes at any time, regardless of the foregoing circumstances. Upon conversion, we will deliver cash up to

the aggregate principal amount of the 2013 Notes to be converted and shares of our Class A stock in respect of the remainder, if any,

of our conversion obligation in excess of the aggregate principal amount of the 2013 Notes being converted. As of October 3, 2009,

none of the conditions permitting conversion of the 2013 Notes had been satisfied.

The 2013 Notes were accounted for as a combined instrument. Accordingly, we accounted for the entire agreement as one debt

instrument because the conversion feature does not meet the requirements to be accounted for separately as a derivative financial

instrument.

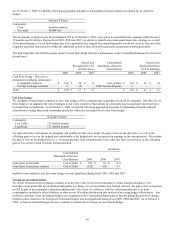

In connection with the issuance of the 2013 Notes, we entered into separate convertible note hedge transactions with respect to our

common stock to minimize the potential economic dilution upon conversion of the 2013 Notes. We also entered into separate warrant

transactions. We recorded the purchase of the note hedge transactions as a reduction to capital in excess of par value, net of $36

million pertaining to the related deferred tax asset, and we recorded the proceeds of the warrant transactions as an increase to capital

in excess of par value. Subsequent changes in fair value of these instruments are not recognized in the financial statements as long as

the instruments continue to meet the criteria for equity classification.

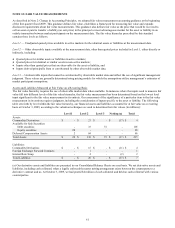

We purchased call options in private transactions for $94 million that permit us to acquire up to approximately 27 million shares of

our Class A stock at an initial strike price of $16.89 per share, subject to adjustment. The call options allow us to acquire a number of

shares of our Class A stock initially equal to the number of shares of Class A stock issuable to the holders of the 2013 Notes upon

conversion. These call options will terminate upon the maturity of the 2013 Notes.

We sold warrants in private transactions for total proceeds of $44 million. The warrants permit the purchasers to acquire up to

approximately 27 million shares of our Class A stock at an initial exercise price of $22.31 per share, subject to adjustment. The

warrants are exercisable on various dates from January 2014 through March 2014.

The maximum amount of shares that may be issued to satisfy the conversion of the 2013 Notes is limited to 35.9 million

shares. However, the convertible note hedge and warrant transactions, in effect, increase the initial conversion price of the 2013

Notes from $16.89 per share to $22.31 per share, thus reducing the potential future economic dilution associated with conversion of

the 2013 Notes. If our share price is below $22.31 upon conversion of the 2013 Notes, there is no economic net share impact. Upon

conversion, a 10% increase in our share price above the $22.31 conversion price would result in the issuance of 2.5 million

incremental shares. The 2013 Notes and the warrants could have a dilutive effect on our earnings per share to the extent the price of

our Class A stock during a given measurement period exceeds the respective exercise prices of those instruments. The call options are

excluded from the calculation of diluted earnings per share as their impact is anti-dilutive.

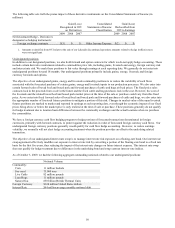

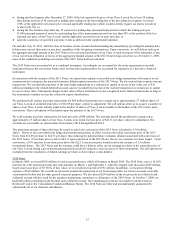

2014 Notes

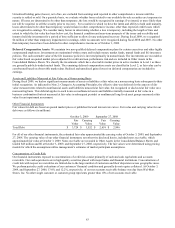

In March 2009, we issued $810 million of senior unsecured notes, which will mature in March 2014. The 2014 Notes carry a 10.50%

interest rate, with interest payments due semi-annually on March 1 and September 1. After the original issue discount of $59 million,

based on an issue price of 92.756% of face value, we received net proceeds of $751 million. In addition, we incurred offering

expenses of $18 million. We used the net proceeds towards the repayment of our borrowings under our former accounts receivable

securitization facility and for other general corporate purposes. We also placed $234 million of the net proceeds in a blocked cash

collateral account which is used for the payment, prepayment, repurchase or defeasance of the 2010 Notes. At October 3, 2009, we

had $140 million remaining in the blocked cash collateral account. The remaining proceeds are recorded in Current Assets as

Restricted Cash in the Consolidated Condensed Balance Sheets. The 2014 Notes are fully and unconditionally guaranteed by

substantially all of our domestic subsidiaries.