Tyson Foods 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

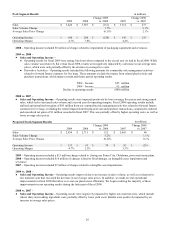

Description

Judgments and Uncertainties

Effect if Actual Results Differ From

Assumptions

Income taxes

We estimate total income tax expense

based on statutory tax rates and tax

planning opportunities available to us in

various jurisdictions in which we earn

income.

Federal income tax includes an estimate

for taxes on earnings of foreign

subsidiaries expected to be remitted to the

United States and be taxable, but not for

earnings considered indefinitely invested

in the foreign subsidiary.

Deferred income taxes are recognized for

the future tax effects of temporary

differences between financial and income

tax reporting using tax rates in effect for

the years in which the differences are

expected to reverse.

Valuation allowances are recorded when it

is likely a tax benefit will not be realized

for a deferred tax asset.

We record unrecognized tax benefit

liabilities for known or anticipated tax

issues based on our analysis of whether,

and the extent to which, additional taxes

will be due.

Changes in tax laws and rates could

affect recorded deferred tax assets and

liabilities in the future.

Changes in projected future earnings

could affect the recorded valuation

allowances in the future.

Our calculations related to income taxes

contain uncertainties due to judgment

used to calculate tax liabilities in the

application of complex tax regulations

across the tax jurisdictions where we

operate.

Our analysis of unrecognized tax

benefits contains uncertainties based on

judgment used to apply the more likely

than not recognition and measurement

thresholds.

We do not believe there is a reasonable

likelihood there will be a material

change in the tax related balances or

valuation allowances. However, due to

the complexity of some of these

uncertainties, the ultimate resolution

may result in a payment that is

materially different from the current

estimate of the tax liabilities.

To the extent we prevail in matters for

which unrecognized tax benefits have

been established, or are required to pay

amounts in excess of our recorded

unrecognized tax benefits, our effective

tax rate in a given financial statement

period could be materially affected. An

unfavorable tax settlement would require

use of our cash and result in an increase

in our effective tax rate in the period of

resolution. A favorable tax settlement

would be recognized as a reduction in

our effective tax rate in the period of

resolution.

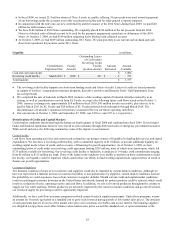

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

MARKET RISK

Market risk relating to our operations results primarily from changes in commodity prices, interest rates and foreign exchange rates,

as well as credit risk concentrations. To address certain of these risks, we enter into various derivative transactions as described

below. If a derivative instrument is accounted for as a hedge, depending on the nature of the hedge, changes in the fair value of the

instrument either will be offset against the change in fair value of the hedged assets, liabilities or firm commitments through earnings,

or be recognized in other comprehensive income (loss) until the hedged item is recognized in earnings. The ineffective portion of an

instrument’s change in fair value is recognized immediately. Additionally, we hold certain positions, primarily in grain and livestock

futures that either do not meet the criteria for hedge accounting or are not designated as hedges. With the exception of normal

purchases and normal sales that are expected to result in physical delivery, we record these positions at fair value, and the unrealized

gains and losses are reported in earnings at each reporting date. Changes in market value of derivatives used in our risk management

activities relating to forward sales contracts are recorded in sales. Changes in market value of derivatives used in our risk

management activities surrounding inventories on hand or anticipated purchases of inventories are recorded in cost of sales.

The sensitivity analyses presented below are the measures of potential losses of fair value resulting from hypothetical changes in

market prices related to commodities. Sensitivity analyses do not consider the actions we may take to mitigate our exposure to

changes, nor do they consider the effects such hypothetical adverse changes may have on overall economic activity. Actual changes

in market prices may differ from hypothetical changes.