Tyson Foods 2009 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2009 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.46

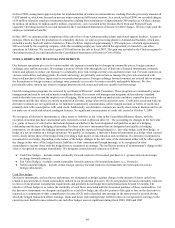

assets or liabilities to be measured at fair value. At the beginning of fiscal 2009, we partially adopted this standard, as allowed, which

delayed the effective date for nonfinancial assets and liabilities. As of the beginning of fiscal 2009, we applied these provisions to our

financial instruments and the impact was not material. We will be required to apply fair value measurements to our nonfinancial

assets and liabilities at the beginning of fiscal 2010. The adoption did not have a significant impact on our consolidated financial

statements.

In February 2007, the FASB issued guidance providing companies with an option to report selected financial assets and liabilities,

firm commitments, and nonfinancial warranty and insurance contracts at fair value on a contract-by-contract basis, with changes in

fair value recognized in earnings each reporting period. When adopted at the beginning of fiscal 2009, we did not elect this fair value

option and, therefore, there was no impact to our consolidated financial statements.

In April 2007, the FASB issued guidance which requires entities that offset the fair value amounts recognized for derivative

receivables and payables to also offset the fair value amounts recognized for the right to reclaim cash collateral with the same

counterparty under a master netting agreement. We applied the provisions of this guidance to our consolidated financial statements

beginning in fiscal 2009. We did not restate prior periods as the impact was not material.

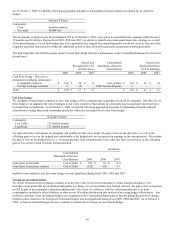

In March 2008, the FASB issued guidance for disclosures about derivative instruments and hedging activities. This guidance

establishes enhanced disclosure requirements about: 1) how and why an entity uses derivative instruments; 2) how derivative

instruments and related hedged items are accounted for; and 3) how derivative instruments and related hedged items affect an entity’s

financial position, financial performance and cash flows. This guidance was effective for financial statements issued for fiscal years

and interim periods beginning after November 15, 2008; therefore, we adopted in fiscal 2009. See Note 6: Derivative Financial

Instruments for required disclosures.

In April 2009, the FASB issued guidance regarding the recognition and presentation of other-than-temporary impairments. This

standard provides new guidance on the recognition and presentation of an other-than-temporary impairment for debt securities

classified as available-for-sale and held-to-maturity and provides certain new disclosure requirements for both debt and equity

securities. This standard was effective for interim and annual periods ending after June 15, 2009, with early adoption permitted for

periods ending after March 15, 2009. We adopted in fiscal 2009. The adoption did not have a significant impact on our consolidated

financial statements.

In April 2009, the FASB issued additional guidance for estimating the fair value of assets and liabilities in markets that have

experienced a significant reduction in volume and activity in relation to normal activity. This guidance was effective for interim and

annual periods ending after June 15, 2009, with early adoption permitted for periods ending after March 15, 2009. We adopted in

fiscal 2009. The adoption did not have a significant impact on our consolidated financial statements.

In April 2009, the FASB issued guidance to require disclosures about fair value of financial instruments in interim financial

statements. This guidance was effective for interim periods ending after June 15, 2009, with early adoption permitted for periods

ending after March 15, 2009. We adopted this guidance during fiscal 2009 and made the required disclosures during our applicable

interim reports.

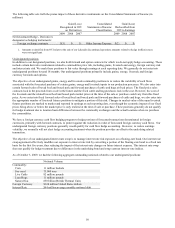

In May 2009, the FASB issued guidance establishing general standards of accounting for and disclosure of events that occur after the

balance sheet date but before financial statements are issued. This standard was effective for interim and annual periods ending after

June 15, 2009. We adopted this guidance in fiscal 2009. See “Subsequent Events” in Note 1: Business and Summary of Significant

Accounting Policies for required disclosures.

NOTE 3: ACQUISITIONS

In August 2009, we completed the establishment of related joint ventures in China referred to as Shandong Tyson Xinchang Foods.

The aggregate purchase price for our 60% equity interest was $21 million, which excludes $93 million of cash transferred to the joint

venture for future capital needs. The preliminary purchase price included $29 million allocated to Intangible Assets and $19 million

allocated to Goodwill, as well as the assumption of $76 million of Current and Long-Term Debt.

In October 2008, we acquired three vertically integrated poultry companies in southern Brazil: Macedo Agroindustrial, Avicola

Itaiopolis and Frangobras. The aggregate purchase price was $67 million, including $4 million of mandatory deferred payments to be

made through fiscal 2011. In addition, we have $15 million of contingent purchase price based on production volumes payable

through fiscal 2011. The purchase price included $23 million allocated to Goodwill and $19 million allocated to Intangible Assets.