Tyson Foods 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

Included in our undesignated positions are certain commodity grain positions (which do not qualify for hedge treatment) we enter into

to manage the risk of costs associated with forward sales to certain customers for which sales prices are determined under cost-plus

arrangements. These unrealized positions totaled losses of $17 million and $24 million at October 3, 2009, and September 27, 2008,

respectively. When these positions are liquidated, we expect any realized gains or losses will be reflected in the prices of the poultry

products sold. Since these derivative positions do not qualify for hedge treatment, they initially create volatility in our earnings

associated with changes in fair value. However, once the positions are liquidated and included in the sales price to the customer, there

is ultimately no earnings impact as any previous fair value gains or losses are included in the prices of the poultry products.

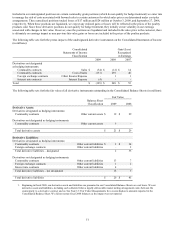

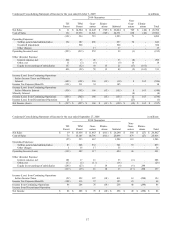

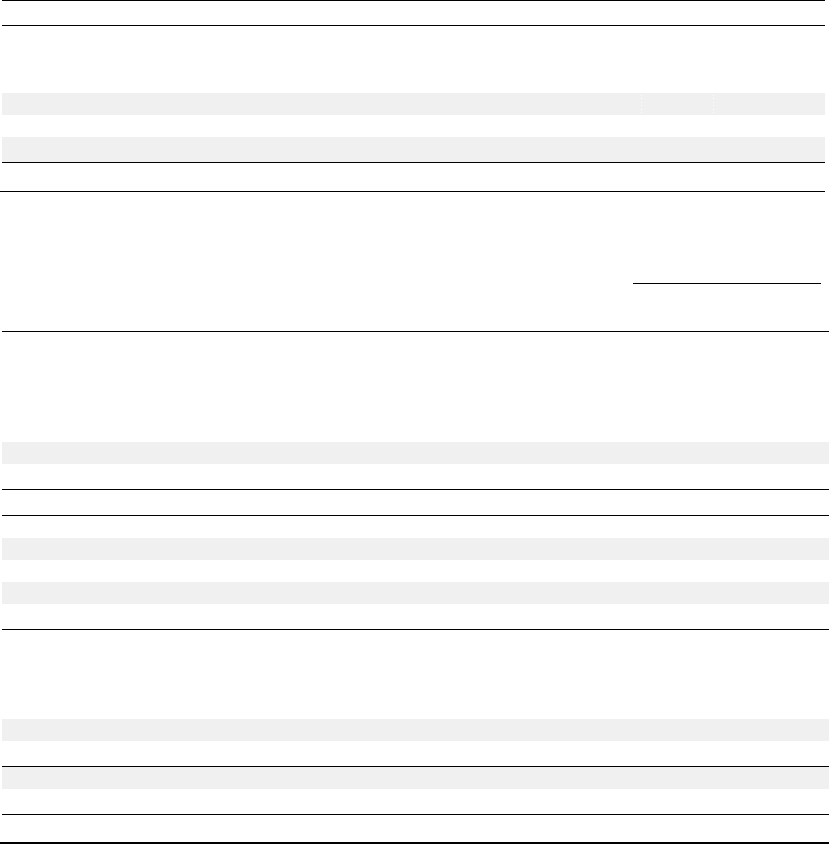

The following table sets forth the pretax impact of the undesignated derivative instruments on the Consolidated Statements of Income

(in millions):

Consolidated

Gain/(Loss)

Statements of Income

Recognized

Classification

in Earnings

2009

2008

2007

Derivatives not designated

as hedging instruments:

Commodity contracts

Sales

$

(34

)

$

(12

)

$

14

Commodity contracts

Cost of Sales

(151

)

259

40

Foreign exchange contracts

Other Income/Expense

-

1

1

Interest rate contracts

Interest Expense

(4

)

-

-

Total

$

(189

)

$

248

$

55

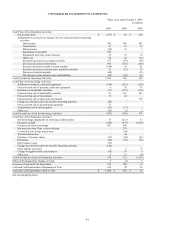

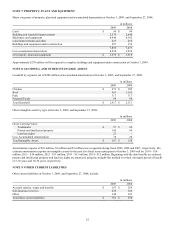

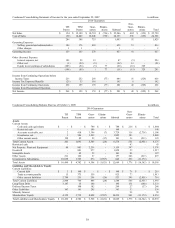

The following table sets forth the fair value of all derivative instruments outstanding in the Consolidated Balance Sheets (in millions):

Fair Value

Balance Sheet

Classification

2009

2008

Derivative Assets:

Derivatives designated as hedging instruments:

Commodity contracts

Other current assets

$

12

$

29

Derivatives not designated as hedging instruments:

Commodity contracts

Other current assets

9

-

Total derivative assets

$

21

$

29

Derivative Liabilities:

Derivatives designated as hedging instruments:

Commodity contracts

Other current liabilities

$

2

$

34

Foreign exchange contracts

Other current liabilities

-

2

Total derivative liabilities – designated

2

36

Derivatives not designated as hedging instruments:

Commodity contracts

Other current liabilities

13

7

Foreign exchange contracts

Other current liabilities

1

2

Interest rate contracts

Other current liabilities

4

-

Total derivative liabilities – not designated

18

9

Total derivative liabilities

$

20

$

45

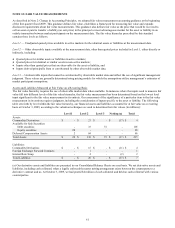

1.

Beginning in fiscal 2009, our derivative assets and liabilities are presented in our Consolidated Balance Sheets on a net basis. We net

derivative assets and liabilities, including cash collateral when a legally enforceable master netting arrangement exists between the

counterparty to a derivative contract and us. See Note 12: Fair Value Measurements for a reconciliation to amounts reported in the

Consolidated Balance Sheet. We did not restate fiscal 2008 balances as the impact was not material.