Time Magazine 2013 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2013 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

Cost-Method Investments

The Company’s cost-method investments include its investment in the Series B convertible redeemable

preferred shares of CME as well as its investments in entities such as start-up companies and investment funds.

The Company uses available qualitative and quantitative information to evaluate all cost-method investments for

impairment at least quarterly.

Gain on Sale of Investments

For the years ended December 31, 2013, the Company recognized net gains of $76 million, primarily related

to a gain on the sale of the Company’s investment in a theater venture in Japan and for the years ended

December 31, 2012 and 2011, the Company recognized net gains of $11 million and $14 million, respectively,

related to the sale of various investments.

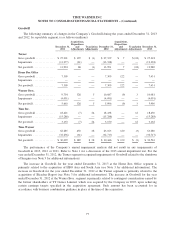

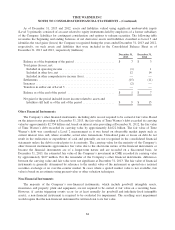

Investment Writedowns

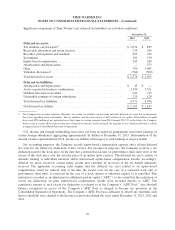

For the years ended December 31, 2013, 2012 and 2011, the Company incurred writedowns to reduce the

carrying value of certain investments that experienced other-than-temporary impairments, as set forth below

(millions):

December 31,

2013 2012 2011

Equity-method investments .....................................$5$25$142

Cost-method investments ...................................... 5 14 6

Available-for-sale securities ....................................77—

Total ....................................................... $ 17 $ 46 $ 148

The impairment of equity-method investments incurred during the year ended December 31, 2012 is

primarily related to the shutdown of TNT television operations in Turkey. The impairments of equity-method

investments incurred during the year ended December 31, 2011 are primarily related to the Company’s

investment in CME. For more information on these investments, see Note 3. While Time Warner has recognized

all declines that are believed to be other-than-temporary as of December 31, 2013, it is reasonably possible that

individual investments in the Company’s portfolio may experience other-than-temporary declines in value in the

future if the underlying investees experience poor operating results or the U.S. or certain foreign equity markets

experience further declines in value.

82