Time Magazine 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)

On January 31, 2013, Time Warner’s Board of Directors authorized up to $4.0 billion of share repurchases

beginning January 1, 2013, including amounts available under the Company’s prior stock repurchase program as

of December 31, 2012. On January 30, 2014, Time Warner’s Board of Directors authorized up to $5.0 billion of

share repurchases beginning January 1, 2014, including amounts available under the Company’s prior stock

repurchase program as of December 31, 2013. Purchases under the stock repurchase program may be made from

time to time on the open market and in privately negotiated transactions. The size and timing of these purchases

are based on a number of factors, including price and business and market conditions. From January 1, 2013

through December 31, 2013, the Company repurchased 60 million shares of common stock for $3.700 billion

pursuant to trading plans under Rule 10b5-1 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). From January 1, 2014 through February 19, 2014, the Company repurchased 7 million shares of common

stock for $440 million pursuant to trading plans under Rule 10b5-1 of the Exchange Act.

On January 16, 2014, Time Warner sold the office space it owned in Time Warner Center for approximately

$1.3 billion. Time Warner also agreed to lease office space in Time Warner Center from the buyer until early

2019. In connection with these transactions, the Company expects to recognize a pretax gain of approximately

$700 million to $800 million, of which approximately $400 million to $500 million will be recognized in the first

quarter of 2014. The balance of the gain will be deferred and recognized ratably over the lease period. Time

Warner also expects to recognize a tax benefit of $50 million to $70 million related to the sale in the first quarter

of 2014. In addition, the Company reached preliminary agreement relating to the move of its Corporate

headquarters and its New York City-based employees to the Hudson Yards development on the west side of

Manhattan. The preliminary agreement is subject to the negotiation and execution of final agreements.

Cash Flows

Cash and equivalents decreased by $979 million for the year ended December 31, 2013 and $635 million for

the year ended December 31, 2012. Components of these changes are discussed below in more detail.

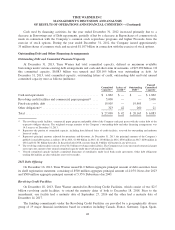

Operating Activities

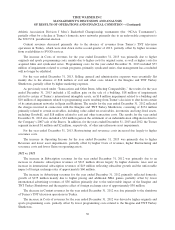

Details of Cash provided by operations are as follows (millions):

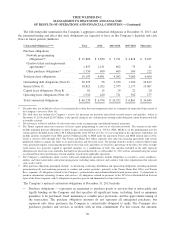

Year Ended December 31,

2013 2012 2011

Operating Income ...................................... $ 6,605 $ 5,918 $ 5,805

Depreciation and amortization ............................ 886 892 922

Net interest payments(a) ................................. (1,158) (1,220) (1,079)

Net income taxes paid(b) ................................. (1,165) (1,274) (1,079)

All other, net, including working capital changes ............. (1,452) (840) (1,121)

Cash provided by operations from continuing operations ....... $ 3,716 $ 3,476 $ 3,448

(a) Includes interest income received of $44 million, $42 million and $40 million in 2013, 2012 and 2011, respectively.

(b) Includes income tax refunds received of $87 million, $78 million and $95 million in 2013, 2012 and 2011, respectively, and income tax

sharing payments to TWC of $6 million in 2012.

Cash provided by operations for the year ended December 31, 2013 increased primarily due to higher

Operating Income, lower net income taxes paid and lower net interest payments, partially offset by higher cash

used by working capital, which primarily reflected higher participation payments and advances.

Cash provided by operations from continuing operations for the year ended December 31, 2012 was

essentially flat as lower cash used by working capital, which primarily reflected lower production spending, and

46