Time Magazine 2013 Annual Report Download - page 67

Download and view the complete annual report

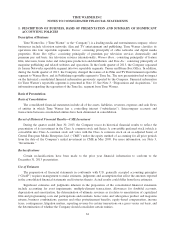

Please find page 67 of the 2013 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)

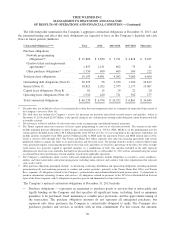

presented in the table alone do not provide a reliable indication of all of the Company’s expected future

cash outflows. For purposes of identifying and accumulating purchase obligations, all material contracts

meeting the definition of a purchase obligation have been included. For those contracts involving a fixed

or minimum quantity, but with variable pricing terms, the Company has estimated the contractual

obligation based on its best estimate of the pricing that will be in effect at the time the obligation is

incurred. Additionally, the Company has included only the obligations under the contracts as they

existed at December 31, 2013, and has not assumed that the contracts will be renewed or replaced at the

end of their respective terms. If a contract includes a penalty for non-renewal, the Company has included

that penalty, assuming it will be paid in the period after the contract expires. If Time Warner can

unilaterally terminate an agreement simply by providing a certain number of days notice or by paying a

termination fee, the Company has included the amount of the termination fee or the amount that would

be paid over the “notice period.” Contracts that can be unilaterally terminated without incurring a

penalty have not been included.

• Outstanding debt obligations — represents the principal amounts due on outstanding debt obligations as

of December 31, 2013. Amounts do not include any fair value adjustments, bond premiums, discounts,

interest payments or dividends.

• Interest — represents amounts due based on the outstanding debt balances, interest rates and maturity

schedules of the respective instruments as of December 31, 2013. The amount of interest ultimately paid

on these instruments may differ based on changes in interest rates.

• Capital lease obligations — represents the minimum lease payments under noncancelable capital leases,

primarily for certain transponder leases at the Home Box Office and Turner segments.

• Operating lease obligations — represents the minimum lease payments under noncancelable operating

leases, primarily for the Company’s real estate and operating equipment.

Most of the Company’s other long-term liabilities reflected in the accompanying Consolidated Balance Sheet

have been included in Network programming obligations in the contractual obligations table above, the most

significant of which is an approximate $1.076 billion liability for film licensing obligations. However, certain

long-term liabilities and deferred credits have been excluded from the table because there are no cash outflows

associated with them (e.g., deferred revenue) or because the cash outflows associated with them are uncertain or

do not meet the definition of a purchase obligation (e.g., deferred taxes, participations and royalties, deferred

compensation and other miscellaneous items).

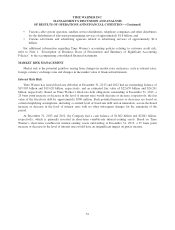

Contingent Commitments

The Company has certain contractual arrangements that require it to make payments or provide funding if

certain circumstances occur. See Note 16, “Commitments and Contingencies,” to the accompanying consolidated

financial statements for further discussion of this item.

Customer Credit Risk

Customer credit risk represents the potential for financial loss if a customer is unwilling or unable to meet its

agreed upon contractual payment obligations. Credit risk in the Company’s businesses originates from sales of

various products or services and is dispersed among many different counterparties. At December 31, 2013, no

single customer had a receivable balance greater than 5% of total Receivables. The Company’s exposure to

customer credit risk is largely concentrated in the following categories (amounts presented below are net of

reserves and allowances):

• Various retailers for home entertainment product of approximately $1.2 billion;

• Various television network operators for licensed TV and film product of approximately $2.9 billion;

51