Time Magazine 2013 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2013 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

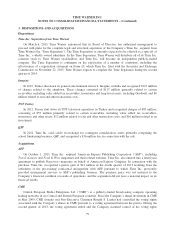

Intangible Assets

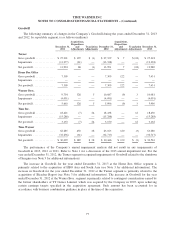

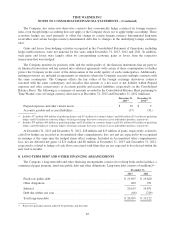

The Company recorded noncash impairments of intangible assets during the years ended December 31, 2013,

2012 and 2011 by reportable segment, as follows (millions):

Year Ended December 31,

2013 2012 2011

Turner ......................................................... $ 18 $ 79 $ 5

Warner Bros. ....................................................111

Time Inc. ....................................................... 78 — 13

Time Warner .................................................... $ 97 $ 80 $ 19

For the year ended December 31, 2013, the Company recorded an impairment of intangible assets at the

Time Inc. segment in connection with the performance of its annual impairment analysis as well as in connection

with triggering events affecting two of its tradenames. For the year ended December 31, 2012, the Turner

segment recognized impairments of both Goodwill and intangible assets related to the shutdown of Imagine (see

Note 3 for additional information). The impairments noted above did not result in non-compliance with respect to

any debt covenants.

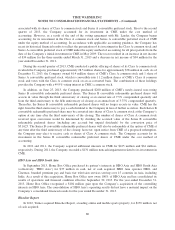

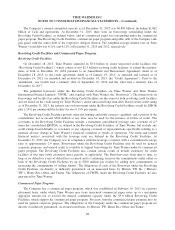

The Company’s intangible assets subject to amortization and related accumulated amortization consisted of

the following (millions):

December 31, 2013 December 31, 2012

Gross

Accumulated

Amortization(a) Net Gross

Accumulated

Amortization(a) Net

Intangible assets subject to

amortization:

Film library ...................... $ 3,452 $(2,494) $ 958 $ 3,452 $(2,345) $ 1,107

Brands, tradenames and other

intangible assets ................. 2,156 (1,194) 962 2,145 (1,144) 1,001

Total ............................ $ 5,608 $(3,688) $ 1,920 $ 5,597 $(3,489) $ 2,108

(a) The film library is amortized using a film forecast computation methodology. Amortization of brands, tradenames and other intangible

assets subject to amortization is provided generally on a straight-line basis over their respective useful lives.

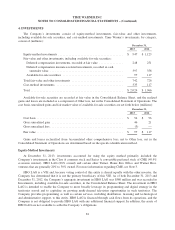

Effective January 1, 2014, certain tradenames at the Time Inc. segment with a carrying value totaling

approximately $586 million that were previously assigned indefinite lives have been assigned finite lives of 17

years and will begin to be amortized starting in January 2014.

The Company recorded amortization expense of $251 million in 2013 compared to $248 million in 2012 and

$269 million in 2011. Amortization may vary as acquisitions and dispositions occur in the future and as purchase

price allocations are finalized. The Company’s estimated amortization expense for the succeeding five years

ended December 31 is as follows (millions):

2014 2015 2016 2017 2018

Estimated amortization expense ............. $ 274 $ 259 $ 249 $ 241 $ 236

78