Time Magazine 2013 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2013 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

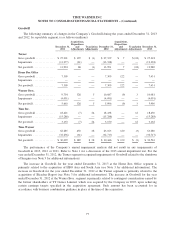

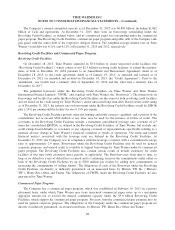

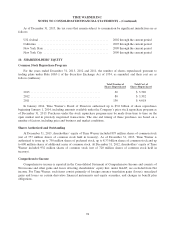

During the year ended December 31, 2013, the Company performed impairment reviews of certain

tradenames and software costs at Time Inc. as well as other intangible assets at certain international subsidiaries

at Turner. As a result, the Company recorded noncash impairments of $97 million to write down the value of

these assets to $492 million. During the year ended December 31, 2012, the Company performed an impairment

review of certain long-lived assets at Imagine, Turner’s general entertainment network in India. As a result of its

review, the Company recorded a noncash impairment of $19 million to write down the value of certain long-lived

assets, primarily intangible assets, to zero. In both periods, the resulting fair value measurements were considered

to be Level 3 measurements and were determined using a DCF methodology with assumptions for cash flows

associated with the use and eventual disposition of the assets.

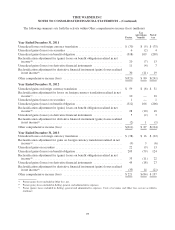

In determining the fair value of its theatrical films, the Company employs a DCF methodology that includes

cash flow estimates of a film’s ultimate revenue and costs as well as a discount rate. The discount rate utilized in

the DCF analysis is based on the weighted average cost of capital of the respective business (e.g., Warner Bros.)

plus a risk premium representing the risk associated with producing a particular theatrical film. The fair value of

any theatrical film and television production that management plans to abandon is zero. As the primary

determination of fair value is determined using a DCF model, the resulting fair value is considered a Level 3

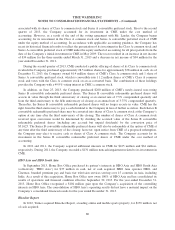

measurement. The following table presents certain theatrical film and television production costs, which were

recorded as inventory in the Consolidated Balance Sheet, that were written down to fair value (millions):

Carrying value

before write down

Carrying value

after write down

Fair value measurements made during the year ended

December 31,:

2013 .................................................. $ 289 $ 206

2012 .................................................. 414 257

85