Time Magazine 2013 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2013 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

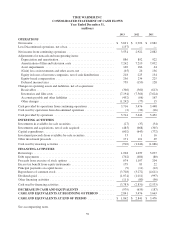

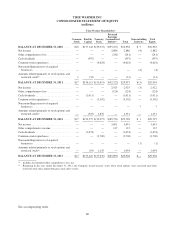

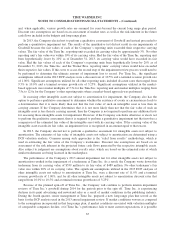

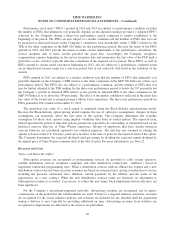

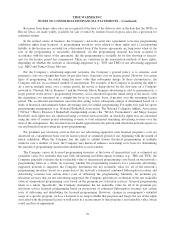

TIME WARNER INC.

CONSOLIDATED STATEMENT OF EQUITY

(millions)

Time Warner Shareholders’

Common

Stock

Paid-In

Capital

Treasury

Stock

Retained

Earnings

(Accumulated

Deficit)(a) Total

Noncontrolling

Interests

Total

Equity

BALANCE AT DECEMBER 31, 2010 ..... $16 $157,142 $(29,033) $(95,167) $32,958 $ 5 $32,963

Net income ............................. — — — 2,886 2,886 (4) 2,882

Other comprehensive loss ................. — — — (241) (241) — (241)

Cash dividends .......................... — (997) — — (997) — (997)

Common stock repurchases ................ — — (4,618) — (4,618) — (4,618)

Noncontrolling interests of acquired

businesses ........................... — — — — — (4) (4)

Amounts related primarily to stock options and

restricted stock(b) ...................... 1 (32) — — (31) — (31)

BALANCE AT DECEMBER 31, 2011 ..... $17 $156,113 $(33,651) $(92,522) $29,957 $ (3) $29,954

Net income ............................. — — — 2,925 2,925 (3) 2,922

Other comprehensive loss ................. — — — (124) (124) — (124)

Cash dividends .......................... — (1,011) — — (1,011) — (1,011)

Common stock repurchases ................ — — (3,302) — (3,302) — (3,302)

Noncontrolling interests of acquired

businesses ........................... — — — — — 7 7

Amounts related primarily to stock options and

restricted stock(b) ...................... — (525) 1,876 — 1,351 — 1,351

BALANCE AT DECEMBER 31, 2012 ..... $17 $154,577 $(35,077) $(89,721) $29,796 $ 1 $29,797

Net income ............................. — — — 3,691 3,691 — 3,691

Other comprehensive income .............. — — — 137 137 — 137

Cash dividends .......................... — (1,074) — — (1,074) — (1,074)

Common stock repurchases ................ — — (3,700) — (3,700) — (3,700)

Noncontrolling interests of acquired

businesses ........................... — — — — — (1) (1)

Amounts related primarily to stock options and

restricted stock(b) ...................... — (93) 1,147 — 1,054 — 1,054

BALANCE AT DECEMBER 31, 2013 ..... $17 $153,410 $(37,630) $(85,893) $29,904 $— $29,904

(a) Includes Accumulated other comprehensive loss, net.

(b) Beginning in the year ended December 31, 2012, the Company issued treasury stock when stock options were exercised and when

restricted stock units and performance stock units vested.

See accompanying notes.

60