Time Magazine 2013 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2013 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

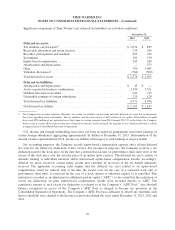

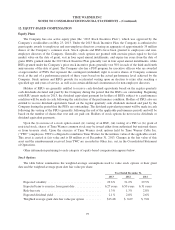

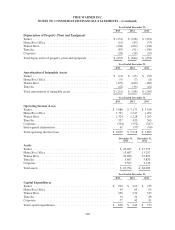

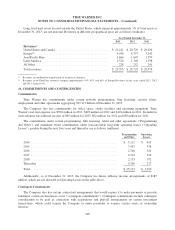

Fair Value of Plan Assets

The following table sets forth by level, within the fair value hierarchy described in Note 5, the assets held by

the Company’s defined benefit pension plans, including those assets related to The CW sub-plan, as of

December 31, 2013 and December 31, 2012 (millions):

December 31, 2013 December 31, 2012

Asset Category Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total

Cash and cash equivalents ........ $ 155 $ — $ — $ 155 $ 113 $ —$—$ 113

Insurance contracts ............. — 18 — 18 — 16 — 16

Equity securities:

Domestic equities ............ 204 — — 204 176 — — 176

International equities .......... 56 — — 56 45 — — 45

Fixed income securities:

U.S. government and agency

securities(c) ................ 239 19 — 258 286 16 — 302

Non-U.S. government and

agency securities ........... 61 — — 61 — — — —

Municipal bonds ............. — 23 — 23 — 27 — 27

Investment grade corporate

bonds(a) ................... — 1,048 — 1,048 — 1,212 — 1,212

Non-investment grade corporate

bonds(a) ................... — 23 — 23 — 25 — 25

Other investments:

Pooled investments(b) .......... — 1,120 — 1,120 — 1,042 — 1,042

Commingled trust funds(c) ...... — 391 — 391 — 307 — 307

Hedge funds ................. — — 36 36 — — 63 63

Other (d) .................... 15 10 40 65 41 2 41 84

Total(e) ....................... $ 730 $ 2,652 $ 76 $ 3,458 $ 661 $ 2,647 $ 104 $ 3,412

(a) Investment grade corporate bonds have an S&P rating of BBB- or higher and non-investment grade corporate bonds have an S&P rating

of BB+ or below.

(b) Pooled investments primarily consist of interests in unitized investment pools of which underlying securities primarily consist of equity

and fixed income securities.

(c) As of December 31, 2013, commingled trust funds include $11 million of cash collateral for securities on loan, and U.S. government and

agency securities include $5 million of securities collateral for securities on loan. As of December 31, 2012, commingled trust funds

included $18 million of cash collateral for securities on loan, and U.S. government and agency securities included $1 million of securities

collateral for securities on loan.

(d) Other investments primarily include limited partnerships, 103-12 investments, derivative contracts, exchange-traded funds and mutual

funds.

(e) At December 31, 2013 and December 31, 2012, total assets include $15 million and $19 million, respectively, of securities on loan.

102