Time Magazine 2013 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2013 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

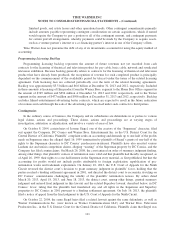

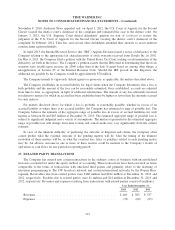

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

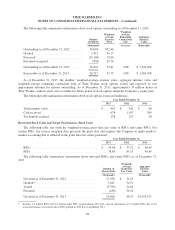

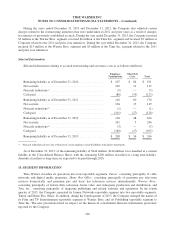

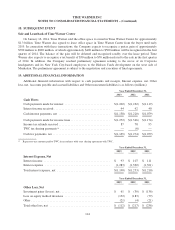

Year Ended December 31,

2013 2012 2011

Depreciation of Property, Plant and Equipment

Turner .................................................. $ (231) $ (238) $ (251)

Home Box Office ......................................... (91) (85) (75)

Warner Bros. ............................................. (200) (202) (198)

Time Inc. ................................................ (85) (91) (100)

Corporate ............................................... (28) (28) (29)

Total depreciation of property, plant and equipment .............. $ (635) $ (644) $ (653)

Year Ended December 31,

2013 2012 2011

Amortization of Intangible Assets

Turner .................................................. $ (21) $ (25) $ (33)

Home Box Office ......................................... (9) (7) (8)

Warner Bros. ............................................. (179) (180) (186)

Time Inc. ................................................ (42) (36) (42)

Total amortization of intangible assets ......................... $ (251) $ (248) $ (269)

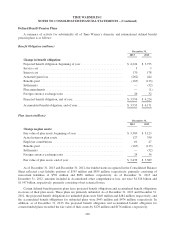

Year Ended December 31,

2013 2012 2011

Operating Income (Loss)

Turner .................................................. $ 3,486 $ 3,172 $ 3,014

Home Box Office ......................................... 1,791 1,547 1,402

Warner Bros. ............................................. 1,324 1,228 1,263

Time Inc. ................................................ 337 420 563

Corporate ............................................... (394) (352) (347)

Intersegment eliminations ................................... 61 (97) (90)

Total operating income (loss) ................................ $ 6,605 $ 5,918 $ 5,805

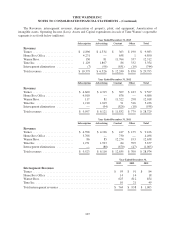

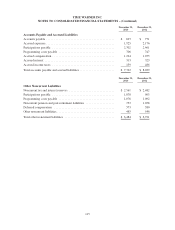

December 31,

2013

December 31,

2012

Assets

Turner ...................................................... $ 26,067 $ 25,953

Home Box Office ............................................. 13,687 13,297

Warner Bros. ................................................ 20,066 19,853

Time Inc. ................................................... 5,667 5,850

Corporate ................................................... 2,507 3,136

Total assets .................................................. $ 67,994 $ 68,089

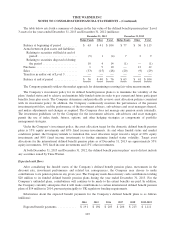

Year Ended December 31,

2013 2012 2011

Capital Expenditures

Turner .................................................. $ 210 $ 229 $ 235

Home Box Office ......................................... 45 65 95

Warner Bros. ............................................. 236 270 313

Time Inc. ................................................ 34 34 48

Corporate ............................................... 77 45 81

Total capital expenditures ................................... $ 602 $ 643 $ 772

108