Time Magazine 2013 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2013 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

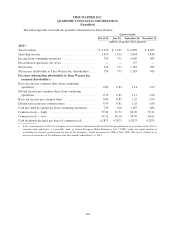

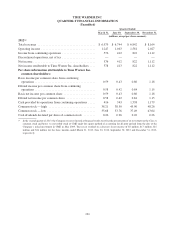

Summary of Items Affecting Comparability

(millions; unaudited)

Year Ended December 31,

2013 2012

Items Affecting Comparability

Asset impairments ................................................ $ (140) $ (186)

Gains on operating assets, net ....................................... 142 9

Other operating income items ....................................... 4 (31)

Gains (losses) on investments ....................................... 61 (30)

Other

Amounts related to separation of Time Warner Cable Inc. ............... 3 4

Amounts related to separation of Warner Music Group ................. (1) (7)

Items affecting comparability relating to equity method investments ...... (30) (94)

Total other .................................................. (28) (97)

Total of above items affecting comparability ........................... 39 (335)

Income tax impact of above items(1) .................................. (34) 100

Impact of items affecting comparability on income (loss) from continuing

operations attributable to Time Warner Inc. shareholders ............... $ 5 $ (235)

(1) For the year ended December 31, 2012, includes $42 million that reflects the reversal of a valuation allowance related to the usage of

capital loss carry forwards in connection with the 2013 sale of the Company’s investment in a joint venture in Japan. The sale of such

investment closed in the first quarter of 2013.

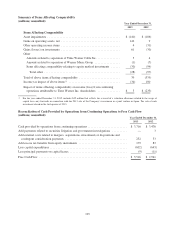

Reconciliation of Cash Provided by Operations from Continuing Operations to Free Cash Flow

(millions; unaudited)

Year Ended December 31,

2013 2012

Cash provided by operations from continuing operations .......................... $ 3,716 $ 3,476

Add payments related to securities litigation and government investigations .......... — 3

Add external costs related to mergers, acquisitions, investments or dispositions and

contingent consideration payments ......................................... 232 33

Add excess tax benefits from equity instruments ................................ 179 83

Less capital expenditures ................................................... (602) (643)

Less principal payments on capital leases ...................................... (9) (11)

Free Cash Flow .......................................................... $ 3,516 $ 2,941

125