Time Magazine 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)

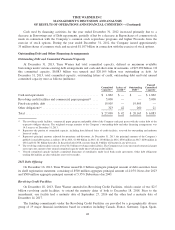

• Various cable system operators, satellite service distributors, telephone companies and other distributors

for the distribution of television programming services of approximately $1.6 billion; and

• Various advertisers and advertising agencies related to advertising services of approximately $1.4

billion.

For additional information regarding Time Warner’s accounting policies relating to customer credit risk,

refer to Note 1, “Description of Business, Basis of Presentation and Summary of Significant Accounting

Policies,” to the accompanying consolidated financial statements.

MARKET RISK MANAGEMENT

Market risk is the potential gain/loss arising from changes in market rates and prices, such as interest rates,

foreign currency exchange rates and changes in the market value of financial instruments.

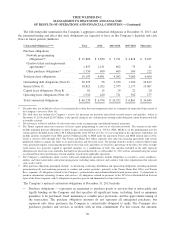

Interest Rate Risk

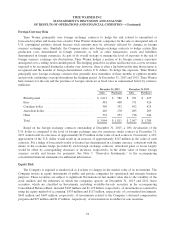

Time Warner has issued fixed-rate debt that at December 31, 2013 and 2012 had an outstanding balance of

$19.905 billion and $19.620 billion, respectively, and an estimated fair value of $22.659 billion and $24.241

billion, respectively. Based on Time Warner’s fixed-rate debt obligations outstanding at December 31, 2013, a

25 basis point increase or decrease in the level of interest rates would decrease or increase, respectively, the fair

value of the fixed-rate debt by approximately $500 million. Such potential increases or decreases are based on

certain simplifying assumptions, including a constant level of fixed-rate debt and an immediate, across-the-board

increase or decrease in the level of interest rates with no other subsequent changes for the remainder of the

period.

At December 31, 2013 and 2012, the Company had a cash balance of $1.862 billion and $2.841 billion,

respectively, which is primarily invested in short-term variable-rate interest-earning assets. Based on Time

Warner’s short-term variable-rate interest-earning assets outstanding at December 31, 2013, a 25 basis point

increase or decrease in the level of interest rates would have an insignificant impact on pretax income.

52