Time Magazine 2013 Annual Report Download - page 127

Download and view the complete annual report

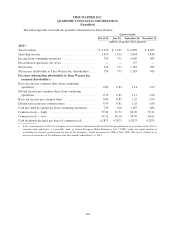

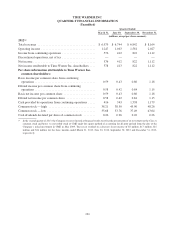

Please find page 127 of the 2013 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

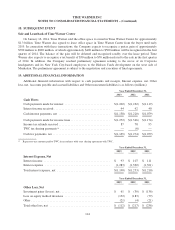

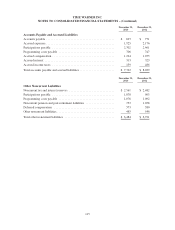

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

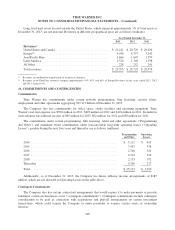

finished goods, real estate leases and other operational needs. Other contingent commitments primarily

include amounts payable representing contingent consideration on certain acquisitions, which if earned

would require the Company to pay a portion or all of the contingent amount, and contingent payments

for certain put/call arrangements, whereby payments could be made by the Company to acquire assets,

such as a venture partner’s interest or a co-financing partner’s interest in one of the Company’s films.

Time Warner does not guarantee the debt of any of its investments accounted for using the equity method of

accounting.

Programming Licensing Backlog

Programming licensing backlog represents the amount of future revenues not yet recorded from cash

contracts for the licensing of theatrical and television product for pay cable, basic cable, network and syndicated

television exhibition. Because backlog generally relates to contracts for the licensing of theatrical and television

product that have already been produced, the recognition of revenue for such completed product is principally

dependent on the commencement of the availability period for telecast under the terms of the related licensing

agreement. Cash licensing fees are collected periodically over the term of the related licensing agreements.

Backlog was approximately $5.5 billion and $6.0 billion at December 31, 2013 and 2012, respectively. Included

in these amounts is licensing of film product from the Warner Bros. segment to the Home Box Office segment in

the amount of $749 million and $654 million at December 31, 2013 and 2012, respectively, and to the Turner

segment in the amount of $477 million and $506 million at December 31, 2013 and 2012, respectively. Backlog

excludes filmed entertainment advertising barter contracts, which are expected to result in the future realization

of revenues and cash through the sale of the advertising spots received under such contracts to third parties.

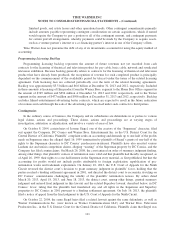

Contingencies

In the ordinary course of business, the Company and its subsidiaries are defendants in or parties to various

legal claims, actions and proceedings. These claims, actions and proceedings are at varying stages of

investigation, arbitration or adjudication, and involve a variety of areas of law.

On October 8, 2004, certain heirs of Jerome Siegel, one of the creators of the “Superman” character, filed

suit against the Company, DC Comics and Warner Bros. Entertainment Inc. in the U.S. District Court for the

Central District of California. Plaintiffs’ complaint seeks an accounting and demands up to one-half of the profits

made on Superman since the alleged April 16, 1999 termination by plaintiffs of Siegel’s grants of one-half of the

rights to the Superman character to DC Comics’ predecessor-in-interest. Plaintiffs have also asserted various

Lanham Act and unfair competition claims, alleging “wasting” of the Superman property by DC Comics, and the

Company has filed counterclaims. On March 26, 2008, the court entered an order of summary judgment finding,

among other things, that plaintiffs’ notices of termination were valid and that plaintiffs had thereby recaptured, as

of April 16, 1999, their rights to a one-half interest in the Superman story material, as first published, but that the

accounting for profits would not include profits attributable to foreign exploitation, republication of pre-

termination works and trademark exploitation. On January 10, 2013, the U.S. Court of Appeals for the Ninth

Circuit reversed the district court’s decision to grant summary judgment in plaintiffs’ favor, holding that the

parties reached a binding settlement agreement in 2001, and directed the district court to reconsider its ruling on

DC Comics’ counterclaims challenging the validity of the plaintiffs’ termination notices. By orders dated

March 20, 2013, April 18, 2013, and June 18, 2013, the district court, among other things, granted summary

judgment and entered final judgment in this lawsuit and the related Superboy lawsuit, described below, in DC

Comics’ favor, ruling that the plaintiffs had transferred any and all rights in the Superman and Superboy

properties to DC Comics in 2001 pursuant to a binding settlement agreement. On July 16, 2013, the plaintiffs

filed a notice of appeal from the final judgment to the U.S. Court of Appeals for the Ninth Circuit.

On October 22, 2004, the same Siegel heirs filed a related lawsuit against the same defendants, as well as

Warner Communications Inc. (now known as Warner Communications LLC) and Warner Bros. Television

Production Inc., in the U.S. District Court for the Central District of California. Plaintiffs claim that Siegel was

111