Time Magazine 2013 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2013 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

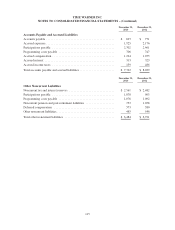

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

18. SUBSEQUENT EVENT

Sale and Leaseback of Time Warner Center

On January 16, 2014, Time Warner sold the office space it owned in Time Warner Center for approximately

$1.3 billion. Time Warner also agreed to lease office space in Time Warner Center from the buyer until early

2019. In connection with these transactions, the Company expects to recognize a pretax gain of approximately

$700 million to $800 million, of which approximately $400 million to $500 million will be recognized in the first

quarter of 2014. The balance of the gain will be deferred and recognized ratably over the lease period. Time

Warner also expects to recognize a tax benefit of $50 million to $70 million related to the sale in the first quarter

of 2014. In addition, the Company reached preliminary agreement relating to the move of its Corporate

headquarters and its New York City-based employees to the Hudson Yards development on the west side of

Manhattan. The preliminary agreement is subject to the negotiation and execution of final agreements.

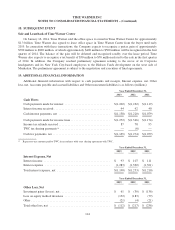

19. ADDITIONAL FINANCIAL INFORMATION

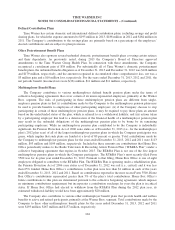

Additional financial information with respect to cash payments and receipts, Interest expense, net, Other

loss, net, Accounts payable and accrued liabilities and Other noncurrent liabilities is as follows (millions):

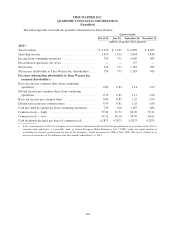

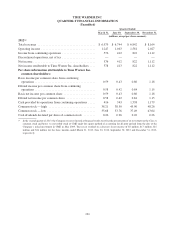

Year Ended December 31,

2013 2012 2011

Cash Flows

Cash payments made for interest .............................. $(1,202) $(1,262) $(1,119)

Interest income received ..................................... 44 42 40

Cash interest payments, net .................................. $(1,158) $(1,220) $(1,079)

Cash payments made for income taxes .......................... $(1,252) $(1,346) $(1,174)

Income tax refunds received .................................. 87 78 95

TWC tax sharing payments(a) ................................. — (6) —

Cash tax payments, net ...................................... $(1,165) $(1,274) $(1,079)

(a) Represents net amounts paid to TWC in accordance with a tax sharing agreement with TWC.

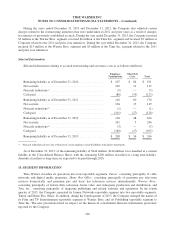

Year Ended December 31,

2013 2012 2011

Interest Expense, Net

Interest income ............................................ $ 93 $ 107 $ 111

Interest expense ........................................... (1,283) (1,360) (1,321)

Total interest expense, net ................................... $(1,190) $(1,253) $(1,210)

Year Ended December 31,

2013 2012 2011

Other Loss, Net

Investment gains (losses), net ................................. $ 61 $ (30) $ (136)

Loss on equity method investees .............................. (152) (183) (79)

Other .................................................... (21) (4) (21)

Total other loss, net ........................................ $ (112) $ (217) $ (236)

114