Time Magazine 2013 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2013 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

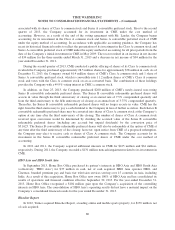

purposes, the Company establishes a reserve for uncertain tax positions unless such positions are determined to

be more likely than not of being sustained upon examination based on their technical merits. There is

considerable judgment involved in determining whether positions taken on the Company’s tax returns are more

likely than not of being sustained.

The Company adjusts its tax reserve estimates periodically because of ongoing examinations by, and

settlements with, the various taxing authorities, as well as changes in tax laws, regulations and interpretations.

The Company’s policy is to recognize, when applicable, interest and penalties on uncertain tax positions as part

of income tax expense. For further information, see Note 9.

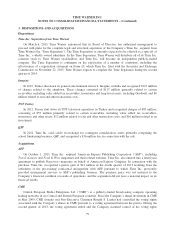

Discontinued Operations

In determining whether a group of assets disposed (or to be disposed) of should be presented as a

discontinued operation, the Company makes a determination of whether the group of assets being disposed of

comprises a component of the entity; that is, whether it has historic operations and cash flows that can be clearly

distinguished (both operationally and for financial reporting purposes). The Company also determines whether

the cash flows associated with the group of assets have been significantly (or will be significantly) eliminated

from the ongoing operations of the Company as a result of the disposal transaction and whether the Company has

no significant continuing involvement in the operations of the group of assets after the disposal transaction. If so,

the results of operations of the group of assets being disposed of (as well as any gain or loss on the disposal

transaction) are aggregated for separate presentation, if material, apart from continuing operating results of the

Company in the consolidated financial statements.

The Company expects to complete the separation of Time Inc. from Time Warner during the second quarter

of 2014. Upon completion of the separation, the Company expects to report the financial position and results of

operations of its Time Inc. segment as discontinued operations. For more information on the separation of Time

Inc. from Time Warner, see Note 3.

During 2013, the Company recognized additional net tax benefits associated with certain foreign tax

attributes of the Warner Music Group, which the Company disposed of in 2004. The net benefit of $137 million

is recognized in Discontinued operations, net of tax in the Consolidated Statement of Operations.

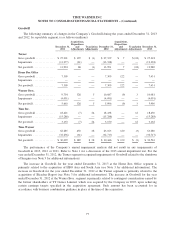

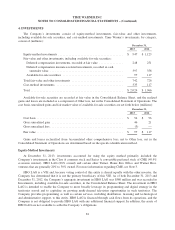

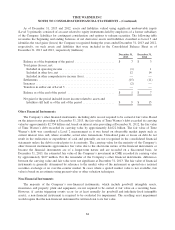

2. GOODWILL AND INTANGIBLE ASSETS

Time Warner has a significant number of intangible assets, acquired film and television libraries and other

copyrighted products and tradenames. Certain intangible assets are deemed to have finite lives and, accordingly,

are amortized over their estimated useful lives, while others are deemed to be indefinite-lived and therefore are

not amortized. Goodwill and indefinite-lived intangible assets, primarily certain tradenames, are tested annually

for impairment during the fourth quarter, or earlier upon the occurrence of certain events or substantive changes

in circumstances.

76