Time Magazine 2013 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2013 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)

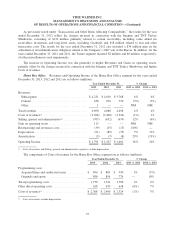

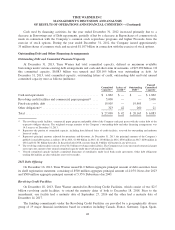

For the year ended December 31, 2013, Advertising revenues decreased primarily due to a $19 million

decline in international magazine advertising revenues, partially offset by a $10 million increase in domestic

magazine advertising revenues. The domestic magazine advertising revenues included $42 million of revenues

resulting from the AEP Acquisition. The decline in magazine advertising revenues was mainly due to market

conditions in the magazine publishing industry. In addition, non-magazine advertising revenues declined $3

million as declines in custom publishing and other non-magazine advertising revenues were largely offset by an

increase in website advertising revenues. Included in website advertising revenues for the year ended

December 31, 2013 was $7 million of revenues resulting from the AEP Acquisition.

For the year ended December 31, 2013, the transfer of the management of the SI.com and Golf.com websites

to Time Inc. from Turner in the second quarter of 2012 had a positive effect on Advertising revenues of $12

million and a $9 million negative effect on Other revenues.

The Company expects the market conditions associated with the Time Inc. segment’s Subscription revenues

and Advertising revenues to continue.

For the year ended December 31, 2013, Costs of revenues decreased due primarily to lower production costs,

mainly reflecting lower paper prices and reduced print volume as well as lower editorial costs primarily

associated with cost savings initiatives, including savings realized from a significant restructuring in the first

quarter of 2013 (the “2013 Restructuring”), which mainly consisted of headcount reductions. In addition, the

decrease in editorial costs for the year ended December 31, 2013 also reflected a $20 million change in the

classification of certain overhead costs. The decreases in production and editorial costs for the year ended

December 31, 2013 were partially offset by $20 million of increased costs resulting from the AEP Acquisition.

Other costs for the year ended December 31, 2013 increased in part due to costs associated with the 2013 Fortune

Global Forum conference.

For the year ended December 31, 2013, Selling, general and administrative expenses increased primarily due

to higher costs of $35 million resulting from the AEP Acquisition, a $20 million change in the classification of

certain overhead costs and a $14 million increase in incentive compensation, partly offset by cost savings

initiatives, including savings realized from the 2013 Restructuring.

As previously noted under “Transactions and Other Items Affecting Comparability,” the results for the year

ended December 31, 2013 included a pretax gain of $13 million resulting from the settlement of a pre-existing

contractual arrangement with AEP and $78 million of asset impairments related to certain tradenames. The

results for the year ended December 31, 2013 and 2012 included $1 million and $6 million, respectively, of

noncash impairments. The results for the year ended December 31, 2012 included a $36 million pretax loss in

connection with the sale of the QSP Business.

The Time Inc. segment incurred $63 million in net Restructuring and severance costs during the year ended

December 31, 2013 primarily in connection with the 2013 Restructuring. The Time Inc. segment expects to incur

charges of approximately $150 million during the first half of 2014, of which about $100 million is expected to

be recognized in the first quarter of 2014, in connection with a significant restructuring, primarily consisting of

headcount reductions and certain lease exit costs.

Operating Income decreased for the year ended December 31, 2013 primarily due to lower Revenues, higher

Asset impairments and higher Restructuring and severance costs, partially offset by lower Costs of revenues and

the absence of the $36 million pretax loss on the sale of the QSP Business.

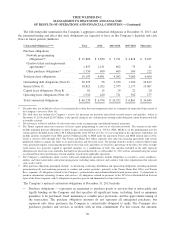

2012 vs. 2011

For the year ended December 31, 2012, Subscription revenues decreased primarily due to lower newsstand

sales, mainly as a result of market conditions in the magazine publishing industry as well as the economic

environment in the U.S. and internationally.

43