Time Magazine 2013 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2013 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

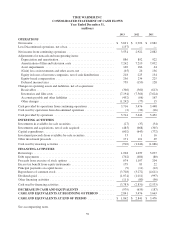

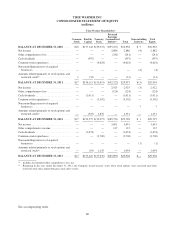

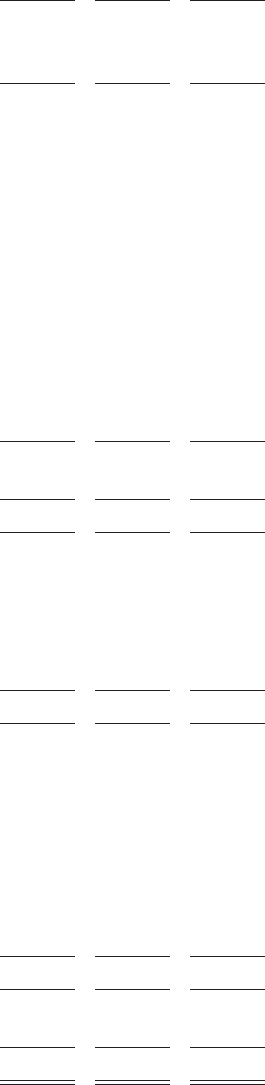

TIME WARNER INC.

CONSOLIDATED STATEMENT OF CASH FLOWS

Year Ended December 31,

(millions)

2013 2012 2011

OPERATIONS

Net income ..................................................... $ 3,691 $ 2,922 $ 2,882

Less Discontinued operations, net of tax .............................. (137) — —

Net income from continuing operations ............................... 3,554 2,922 2,882

Adjustments for noncash and nonoperating items:

Depreciation and amortization .................................... 886 892 922

Amortization of film and television costs ........................... 7,262 7,210 7,032

Asset impairments ............................................. 140 186 44

(Gain) loss on investments and other assets, net ...................... (65) 26 136

Equity in losses of investee companies, net of cash distributions ......... 218 225 134

Equity-based compensation ...................................... 256 234 225

Deferred income taxes .......................................... 759 (150) 128

Changes in operating assets and liabilities, net of acquisitions:

Receivables ................................................... (366) (360) (613)

Inventories and film costs ....................................... (7,194) (7,566) (7,624)

Accounts payable and other liabilities .............................. (492) (66) 167

Other changes ................................................. (1,242) (77) 15

Cash provided by operations from continuing operations ................. 3,716 3,476 3,448

Cash used by operations from discontinued operations ................... (2) (34) (16)

Cash provided by operations ....................................... 3,714 3,442 3,432

INVESTING ACTIVITIES

Investments in available-for-sale securities ............................ (27) (37) (34)

Investments and acquisitions, net of cash acquired ...................... (485) (668) (365)

Capital expenditures .............................................. (602) (643) (772)

Investment proceeds from available-for-sale securities ................... 33 1 16

Other investment proceeds ......................................... 171 101 69

Cash used by investing activities .................................... (910) (1,246) (1,086)

FINANCING ACTIVITIES

Borrowings ..................................................... 1,028 1,039 3,037

Debt repayments ................................................. (762) (686) (80)

Proceeds from exercise of stock options .............................. 674 1,107 204

Excess tax benefit from equity instruments ............................ 179 83 22

Principal payments on capital leases ................................. (9) (11) (12)

Repurchases of common stock ...................................... (3,708) (3,272) (4,611)

Dividends paid .................................................. (1,074) (1,011) (997)

Other financing activities .......................................... (111) (80) (96)

Cash used by financing activities .................................... (3,783) (2,831) (2,533)

DECREASE IN CASH AND EQUIVALENTS ....................... (979) (635) (187)

CASH AND EQUIVALENTS AT BEGINNING OF PERIOD .......... 2,841 3,476 3,663

CASH AND EQUIVALENTS AT END OF PERIOD ................. $ 1,862 $ 2,841 $ 3,476

See accompanying notes.

59