Time Magazine 2013 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2013 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

During the years ended December 31, 2013 and December 31, 2012, the Company also adjusted certain

charges related to the restructuring initiatives that were undertaken in 2011 and prior years as a result of changes

in estimates of previously established accruals. During the year ended December 31, 2013, the Company incurred

$5 million at the Warner Bros. segment, reversed $6 million at the Time Inc. segment and reversed $3 million at

Corporate related to the 2011 and prior year initiatives. During the year ended December 31, 2012, the Company

incurred $13 million at the Warner Bros. segment and $5 million at the Time Inc. segment related to the 2011

and prior year initiatives.

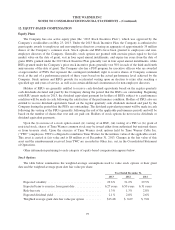

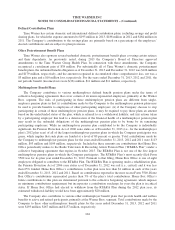

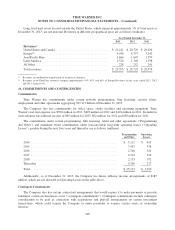

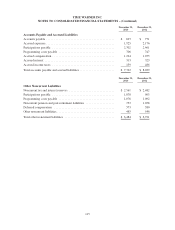

Selected Information

Selected information relating to accrued restructuring and severance costs is as follows (millions):

Employee

Terminations

Other Exit

Costs Total

Remaining liability as of December 31, 2010 ................ $ 107 $ 84 $ 191

Net accruals .......................................... 102 11 113

Noncash reductions(a) ................................... (5) — (5)

Cash paid ............................................ (88) (35) (123)

Remaining liability as of December 31, 2011 ................ 116 60 176

Net accruals .......................................... 104 15 119

Noncash reductions(a) ................................... (1) — (1)

Cash paid ............................................ (101) (27) (128)

Remaining liability as of December 31, 2012 ................ 118 48 166

Net accruals .......................................... 241 5 246

Noncash reductions(a) ................................... (3) — (3)

Cash paid ............................................ (148) (17) (165)

Remaining liability as of December 31, 2013 ................ $ 208 $ 36 $ 244

(a) Noncash reductions relate to the settlement of certain employee-related liabilities with equity instruments.

As of December 31, 2013, of the remaining liability of $244 million, $144 million was classified as a current

liability in the Consolidated Balance Sheet, with the remaining $100 million classified as a long-term liability.

Amounts classified as long-term are expected to be paid through 2020.

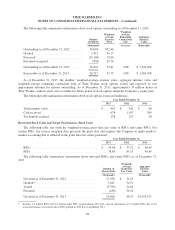

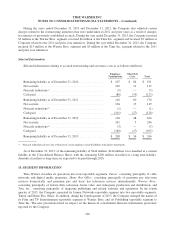

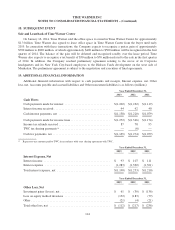

15. SEGMENT INFORMATION

Time Warner classifies its operations into four reportable segments: Turner: consisting principally of cable

networks and digital media properties; Home Box Office: consisting principally of premium pay television

services domestically and premium pay and basic tier television services internationally; Warner Bros.:

consisting principally of feature film, television, home video and videogame production and distribution; and

Time Inc.: consisting principally of magazine publishing and related websites and operations. In the fourth

quarter of 2013, the Company separated its former Networks reportable segment into two reportable segments:

Turner and Home Box Office. In addition, during the fourth quarter of 2013, the Company changed the names of

its Film and TV Entertainment reportable segment to Warner Bros. and its Publishing reportable segment to

Time Inc. The new presentation had no impact on the historical consolidated financial information previously

reported by the Company.

106