Time Magazine 2013 Annual Report Download - page 71

Download and view the complete annual report

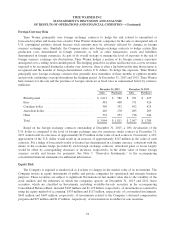

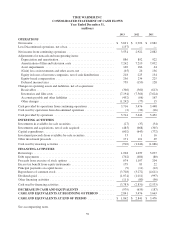

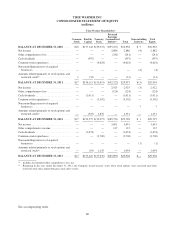

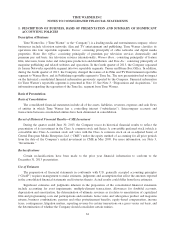

Please find page 71 of the 2013 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)

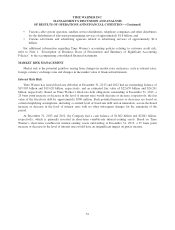

may vary materially from those expressed or implied in its forward-looking statements. Important factors that

could cause the Company’s actual results to differ materially from those in its forward-looking statements

include government regulation, economic, strategic, political and social conditions and the following factors:

• recent and future changes in technology, services and standards, including, but not limited to, alternative

methods for the delivery, storage and consumption of digital media and evolving home entertainment

formats;

• changes in consumer behavior, including changes in spending behavior and changes in when, where and

how digital content is consumed;

• the popularity of the Company’s content;

• changes in the Company’s plans, initiatives and strategies, and consumer acceptance thereof;

• changes in the plans, initiatives and strategies of the third parties that distribute, license and/or sell Time

Warner’s content;

• competitive pressures, including as a result of audience fragmentation and changes in technology;

• the Company’s ability to deal effectively with economic slowdowns or other economic or market

difficulties;

• changes in advertising market conditions or advertising expenditures due to, among other things,

economic conditions, changes in consumer behavior, pressure from public interest groups, changes in

laws and regulations and other societal or political developments;

• piracy and the Company’s ability to exploit and protect its intellectual property rights in and to its

content and other products;

• lower than expected valuations associated with the cash flows and revenues at Time Warner’s reporting

units, which could result in Time Warner’s inability to realize the value recorded for intangible assets

and goodwill at those reporting units;

• increased volatility or decreased liquidity in the capital markets, including any limitation on the

Company’s ability to access the capital markets for debt securities, refinance its outstanding

indebtedness or obtain bank financings on acceptable terms;

• the effects of any significant acquisitions, dispositions and other similar transactions by the Company,

including the Time Separation;

• the failure to meet earnings expectations;

• the adequacy of the Company’s risk management framework;

• changes in U.S. GAAP or other applicable accounting policies;

• the impact of terrorist acts, hostilities, natural disasters (including extreme weather) and pandemic

viruses;

• a disruption or failure of the Company’s or its vendors’ network and information systems or other

technology on which the Company’s businesses rely;

• the effect of union or labor disputes or player lockouts affecting the professional sports leagues whose

programming is shown on the Company’s networks;

• changes in tax, federal communication and other laws and regulations;

• changes in foreign exchange rates and in the stability and existence of the Euro; and

• the other risks and uncertainties detailed in “Risk Factors” in this 2013 Annual Report to Shareholders.

Any forward-looking statement made by the Company in this 2013 Annual Report to Shareholders speaks

only as of the date on which it is made. The Company is under no obligation to, and expressly disclaims any

obligation to, update or alter its forward-looking statements, whether as a result of new information, subsequent

events or otherwise.

55