Time Magazine 2013 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2013 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

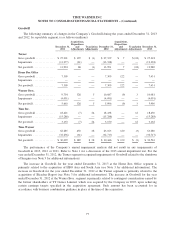

Revenues from home video sales are recognized at the later of the delivery date or the date that the DVDs or

Blu-ray Discs are made widely available for sale or rental by retailers based on gross sales less a provision for

estimated returns.

In the normal course of business, the Company’s networks enter into agreements to license programming

exhibition rights from licensors. A programming inventory asset related to these rights and a corresponding

liability to the licensor are recorded (on a discounted basis if the license agreements are long-term) when (i) the

cost of the programming is reasonably determined, (ii) the programming material has been accepted in

accordance with the terms of the agreement, (iii) the programming is available for its first showing or telecast,

and (iv) the license period has commenced. There are variations in the amortization methods of these rights,

depending on whether the network is advertising-supported (e.g., TNT and TBS) or not advertising-supported

(e.g., HBO and Turner Classic Movies).

For the Company’s advertising-supported networks, the Company’s general policy is to amortize each

program’s costs on a straight-line basis (or per-play basis, if greater) over its license period. However, for certain

types of programming, the initial airing has more value than subsequent airings. In these circumstances, the

Company will use an accelerated method of amortization. For example, if the Company is licensing the right to

air a movie multiple times over a certain period, the movie is being shown for the first time on a Company

network (a “Network Movie Premiere”) and the Network Movie Premiere advertising is sold at a premium rate, a

larger portion of the movie’s programming inventory cost is amortized upon the initial airing of the movie, with

the remaining cost amortized on a straight-line basis (or per-play basis, if greater) over the remaining license

period. The accelerated amortization upon the first airing versus subsequent airings is determined based on a

study of historical and estimated future advertising sales for similar programming. For rights fees paid for sports

programming arrangements (e.g., National Basketball Association, The National Collegiate Athletic Association

(“NCAA”) Men’s Division I Basketball championship events (the “NCAA Tournament”) and Major League

Baseball), such rights fees are amortized using a revenue-forecast model, in which the rights fees are amortized

using the ratio of current period advertising revenue to total estimated remaining advertising revenue over the

term of the arrangement. The revenue-forecast model approximates the pattern with which the network expects to

use and benefit from providing the sports programming.

For premium pay television services that are not advertising-supported, each licensed program’s costs are

amortized on a straight-line basis over its license period or estimated period of use, beginning with the month of

initial exhibition. When the Company has the right to exhibit feature theatrical programming in multiple

windows over a number of years, the Company uses historical audience viewership as its basis for determining

the amount of programming amortization attributable to each window.

The Company carries its licensed programming inventory at the lower of unamortized cost or estimated net

realizable value. For networks that earn both Advertising and Subscription revenues (e.g., TBS and TNT), the

Company generally evaluates the net realizable value of unamortized programming costs based on the network’s

programming taken as a whole. In assessing whether the programming inventory for a particular advertising-

supported network is impaired, the Company determines the net realizable value for all of the network’s

programming inventory based on a projection of the network’s estimated combined Subscription revenues and

Advertising revenues less certain direct costs of delivering the programming. Similarly, for premium pay

television services that are not advertising-supported, the Company performs its evaluation of the net realizable

value of unamortized programming costs based on the premium pay television services’ licensed programming

taken as a whole. Specifically, the Company determines the net realizable value for all of its premium pay

television service licensed programming based on projections of estimated Subscription revenues less certain

costs of delivering and distributing the licensed programming. However, changes in management’s intended

usage of a specific program, such as a decision to no longer exhibit that program and forego the use of the rights

associated with the program license, would result in a reassessment of that program’s net realizable value, which

could result in an impairment.

70