Time Magazine 2013 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2013 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

respectively. Related accumulated amortization totaled $59 million and $49 million as of December 31, 2013 and

2012, respectively.

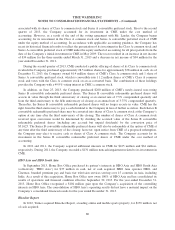

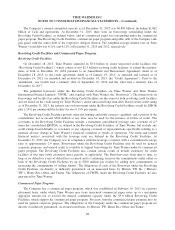

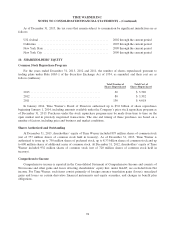

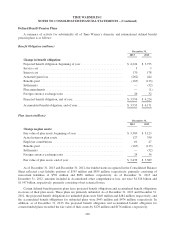

Future minimum capital lease payments at December 31, 2013 are as follows (millions):

2014 ........................................................................ $ 15

2015 ........................................................................ 13

2016 ........................................................................ 11

2017 ........................................................................ 11

2018 ........................................................................ 11

Thereafter .................................................................... 20

Total ........................................................................ 81

Amount representing interest ..................................................... (15)

Present value of minimum lease payments .......................................... 66

Current portion ............................................................... (10)

Total long-term portion ......................................................... $ 56

Film Tax-Advantaged Arrangements

The Company’s film and TV production businesses, on occasion, enter into tax-advantaged transactions with

foreign investors that are thought to generate tax benefits for such investors. The Company believes that its tax

profile is not affected by its participation in these arrangements in any jurisdiction. The foreign investors provide

consideration to the Company for entering into these arrangements.

Although these transactions often differ in form, they generally involve circumstances in which the Company

enters into a sale-leaseback arrangement involving its film product with third-party special purpose entities

(“SPEs”) owned by the foreign investors. The Company maintains its rights and control over the use of its film

product. The Company evaluates these SPEs for consolidation in accordance with its policy. Because the

Company generally does not have a controlling interest in the SPEs, it generally does not consolidate them. In

addition, the Company does not guarantee and is not otherwise responsible for the equity and debt in these SPEs

and does not participate in the profits or losses of these SPEs. The Company accounts for these arrangements

based on their substance, and the Company records the costs of producing the films as an asset and records the

net benefit received from the investors as a reduction of film and television production costs resulting in lower

film and television production cost amortization for the films involved in the arrangement. At December 31,

2013, such SPEs were capitalized with approximately $3.1 billion of debt and equity from the third-party

investors. These transactions resulted in reductions of film and television production cost amortization totaling

$1 million, $10 million and $34 million during the years ended December 31, 2013, 2012 and 2011, respectively.

9. INCOME TAXES

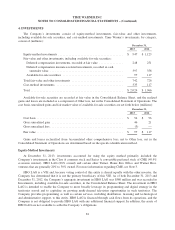

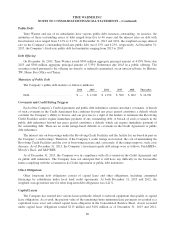

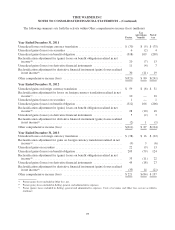

Domestic and foreign income before income taxes and discontinued operations are as follows (millions):

Year Ended December 31,

2013 2012 2011

Domestic ............................................... $ 5,157 $ 4,445 $ 4,285

Foreign ................................................. 146 3 74

Total ................................................... $ 5,303 $ 4,448 $ 4,359

90