Time Magazine 2013 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2013 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

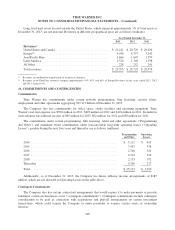

Defined Contribution Plans

Time Warner has certain domestic and international defined contribution plans, including savings and profit

sharing plans, for which the expense amounted to $195 million in 2013, $188 million in 2012 and $184 million in

2011. The Company’s contributions to the savings plans are primarily based on a percentage of the employees’

elected contributions and are subject to plan provisions.

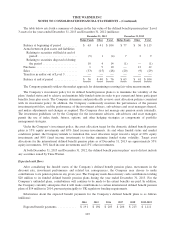

Other Postretirement Benefit Plans

Time Warner also sponsors several unfunded domestic postretirement benefit plans covering certain retirees

and their dependents. As previously noted, during 2013 the Company’s Board of Directors approved

amendments to the Time Warner Group Health Plan. In connection with these amendments, the Company

recognized a curtailment gain of $38 million. For substantially all of Time Warner’s domestic postretirement

benefit plans, the unfunded benefit obligation as of December 31, 2013 and December 31, 2012 was $126 million

and $179 million, respectively, and the amount recognized in Accumulated other comprehensive loss, net was a

$3 million gain and a $10 million loss, respectively. For the years ended December 31, 2013, 2012 and 2011, the

net periodic benefit (income)/costs were $(28) million, $11 million and $11 million, respectively.

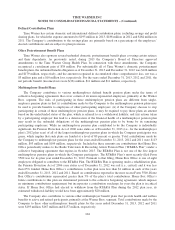

Multiemployer Benefit Plans

The Company contributes to various multiemployer defined benefit pension plans under the terms of

collective-bargaining agreements that cover certain of its union-represented employees, primarily at the Warner

Bros. segment. The risks of participating in these multiemployer pension plans are different from single-

employer pension plans in that (i) contributions made by the Company to the multiemployer pension plans may

be used to provide benefits to employees of other participating employers; (ii) if the Company chooses to stop

participating in certain of these multiemployer pension plans, it may be required to pay those plans an amount

based on the underfunded status of the plan, which is referred to as a withdrawal liability; and (iii) actions taken

by a participating employer that lead to a deterioration of the financial health of a multiemployer pension plan

may result in the unfunded obligations of the multiemployer pension plan to be borne by its remaining

participating employers. While no multiemployer pension plan contributed to by the Company is individually

significant, the Pension Protection Act of 2006 zone status as of December 31, 2013 (i.e., for the multiemployer

plan’s 2012 plan year) of all of the largest multiemployer pension plans in which the Company participates was

green, which implies that such plans are funded at a level of 80 percent or greater. Total contributions made by

the Company to multiemployer pension plans for the years ended December 31, 2013, 2012 and 2011 were $113

million, $93 million and $109 million, respectively. Included in these amounts are contributions that Home Box

Office periodically makes to the Radio Television & Recording Artists Pension Plan (“RT&RA Plan”) under a

collective bargaining agreement that expires in October 2015. The RT&RA Plan is not one of the five largest

multiemployer pension plans in which the Company participates. The RT&RA Plan’s most recently filed Form

5500 was for its plan year ended December 31, 2012. Pursuant to that filing, Home Box Office is one of eight

employers obligated to contribute to the RT&RA Plan. The RT&RA Plan is operating under a rehabilitation plan,

the Pension Protection Act of 2006 zone status as of December 31, 2012 was red (i.e., critical) and it was less

than 65% funded. Home Box Office’s contributions to this plan were less than $1 million in each of the years

ended December 31, 2013, 2012 and 2011. Based on contributions reported in the most recent Form 5500, Home

Box Office’s contributions represented greater than 5% of the plan’s total contributions. Home Box Office’s

future contributions to this plan are determined pursuant to the collective bargaining agreement, which imposes

no minimum contributions requirement, but incorporates a contribution surcharge for years the plan is in critical

status. If Home Box Office had elected to withdraw from the RT&RA Plan during the 2012 plan year, its

estimated withdrawal liability would have been approximately $20 million.

The Company also contributes to various other multiemployer benefit plans that provide health and welfare

benefits to active and retired participants, primarily at the Warner Bros. segment. Total contributions made by the

Company to these other multiemployer benefit plans for the years ended December 31, 2013, 2012 and 2011

were $193 million, $167 million and $157 million, respectively.

104