Time Magazine 2013 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2013 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

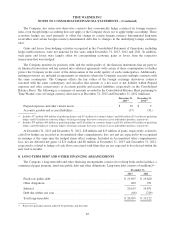

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

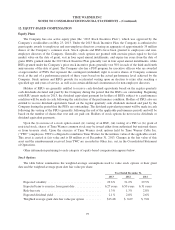

12. EQUITY-BASED COMPENSATION

Equity Plans

The Company has one active equity plan (the “2013 Stock Incentive Plan”), which was approved by the

Company’s stockholders on May 23, 2013. Under the 2013 Stock Incentive Plan, the Company is authorized to

grant equity awards to employees and non-employee directors covering an aggregate of approximately 35 million

shares of the Company’s common stock. Stock options and RSUs have been granted to employees and non-

employee directors of the Company. Generally, stock options are granted with exercise prices equal to the fair

market value on the date of grant, vest in four equal annual installments, and expire ten years from the date of

grant. RSUs granted under the 2013 Stock Incentive Plan generally vest in four equal annual installments, while

RSUs granted under the Company’s prior stock incentive plans generally vest 50% in each of the third and fourth

anniversaries of the date of grant. The Company also has a PSU program for executive officers who are awarded

a target number of PSUs that represent the contingent (unfunded) right to receive shares of Company common

stock at the end of a performance period of three years based on the actual performance level achieved by the

Company. Stock options and RSUs provide for accelerated vesting upon an election to retire after reaching a

specified age and years of service, as well as in certain additional circumstances for non-employee directors.

Holders of RSUs are generally entitled to receive cash dividend equivalents based on the regular quarterly

cash dividends declared and paid by the Company during the period that the RSUs are outstanding. Beginning

with RSU grants made in 2013, the dividend equivalent payment for holders of RSUs subject to a performance

condition will be made in cash following the satisfaction of the performance condition. Holders of PSUs also are

entitled to receive dividend equivalents based on the regular quarterly cash dividends declared and paid by the

Company during the period that the PSUs are outstanding. The dividend equivalent payment will be made in cash

following the vesting of the PSUs (generally following the end of the applicable performance period) and will be

based on the number of shares that vest and are paid out. Holders of stock options do not receive dividends or

dividend equivalent payments.

Upon the (i) exercise of a stock option award, (ii) vesting of an RSU, (iii) vesting of a PSU or (iv) grant of

restricted stock, shares of Time Warner common stock may be issued either from authorized but unissued shares

or from treasury stock. Upon the exercise of Time Warner stock options held by Time Warner Cable Inc.

(“TWC”) employees, TWC is obligated to reimburse Time Warner for the intrinsic value of the applicable award.

This asset is carried at fair value and is $8 million as of December 31, 2013. Changes in the fair value of this

asset and the reimbursement received from TWC are recorded in Other loss, net, in the Consolidated Statement

of Operations.

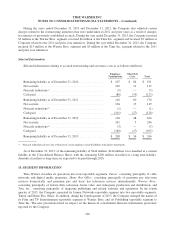

Other information pertaining to each category of equity-based compensation appears below.

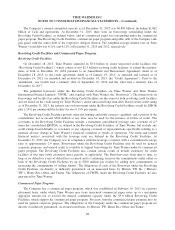

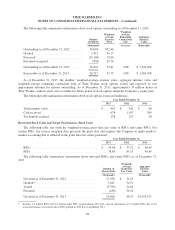

Stock Options

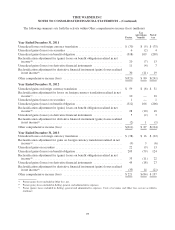

The table below summarizes the weighted-average assumptions used to value stock options at their grant

date and the weighted-average grant date fair value per share:

Year Ended December 31,

2013 2012 2011

Expected volatility ................................... 29.6% 31.2% 29.5%

Expected term to exercise from grant date ................. 6.27 years 6.50 years 6.31 years

Risk-free rate ....................................... 1.3% 1.3% 2.8%

Expected dividend yield ............................... 2.1% 2.8% 2.6%

Weighted average grant date fair value per option .......... $13.48 $ 8.69 $ 9.01

97