Time Magazine 2011 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2011 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

8. LONG-TERM DEBT AND OTHER FINANCING ARRANGEMENTS

The Company’s long-term debt and other financing arrangements consist of revolving bank credit facilities, a

commercial paper program, fixed-rate public debt and other obligations.

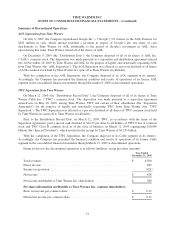

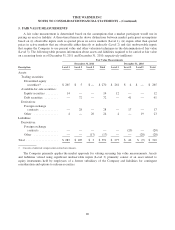

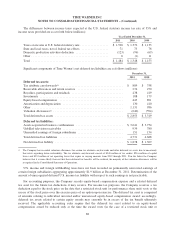

Long-term debt consists of (millions)(a):

Outstanding Debt

December 31,

2011

December 31,

2010

Fixed-rate public debt ......................................... $ 19,251 $ 16,276

Other obligations ............................................. 273 273

Subtotal .................................................... 19,524 16,549

Debt due within one year ....................................... (23) (26)

Total long-term debt .......................................... $ 19,501 $ 16,523

(a) Represents principal amounts adjusted for premiums and discounts.

The Company’s unused committed capacity as of December 31, 2011 was $8.536 billion, including $3.476

billion of Cash and equivalents. At December 31, 2011, there were no borrowings outstanding under the

Revolving Credit Facilities, as defined below, and no commercial paper was outstanding under the commercial

paper program. The Revolving Credit Facilities, commercial paper program and public debt of the Company rank

pari passu with the senior debt of the respective obligors thereon. The weighted-average interest rate on Time

Warner’s total debt was 6.35% and 6.52% at December 31, 2011 and 2010, respectively.

Revolving Credit Facilities and Commercial Paper Program

Revolving Credit Facilities

On September 27, 2011, Time Warner amended its $5.0 billion senior unsecured credit facilities, which had

consisted of a $2.5 billion three-year revolving credit facility and a $2.5 billion five-year revolving credit facility

pursuant to the First Amendment, dated as of September 27, 2011, to the credit agreement, dated as of

January 19, 2011 (the “Credit Agreement”). The amendment changed the $2.5 billion three-year revolving credit

facility to a $2.5 billion four-year revolving credit facility with a maturity date of September 27, 2015 (the “Four-

Year Revolving Credit Facility”) and extended the maturity date of the $2.5 billion five-year revolving credit

facility from January 19, 2016 to September 27, 2016 (the “Five-Year Revolving Credit Facility” and collectively

with the Four-Year Revolving Credit Facility, the “Revolving Credit Facilities”). The amendment also reduced

interest rates and facility fees and eliminated the reference to the percentage of commitments used under the

Revolving Credit Facilities for the purpose of calculating the interest rate on borrowings under the Revolving

Credit Facilities.

The permitted borrowers under the Credit Agreement are Time Warner and Time Warner International

Finance Limited (“TWIFL” and together with Time Warner, the “Borrowers”). The interest rate on borrowings

and facility fees under the Revolving Credit Facilities are based on the credit rating for Time Warner’s senior

unsecured long-term debt. Based on the credit rating as of December 31, 2011, the interest rate on borrowings

under the Four-Year Revolving Credit Facility would be LIBOR plus 1.10% per annum and the facility fee was

0.15% per annum, and the interest rate on borrowings under the Five-Year Revolving Credit Facility would be

LIBOR plus 1.075% per annum and the facility fee was 0.175% per annum.

The Credit Agreement provides same-day funding and multi-currency capability, and a portion of the

commitment, not to exceed $500 million at any time, may be used for the issuance of letters of credit. The

covenants for the Credit Agreement include a maximum consolidated leverage ratio covenant of 4.5 times the

84