Time Magazine 2011 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2011 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

Court of Appeals for the Ninth Circuit. On June 3, 2011, the U.S. Court of Appeals for the Ninth Circuit affirmed

the district court’s dismissal of the lawsuit, and, on July 7, 2011, plaintiffs filed a petition for a rehearing en banc.

On September 21, 2011, one of the judges on the original panel passed away, and on October 31, 2011, the U.S.

Court of Appeals for the Ninth Circuit withdrew its June 3, 2011 decision, directed the clerk to reconstitute the

panel by drawing a third judge and denied the petition for rehearing as moot.

On March 10, 2009, Anderson News L.L.C. and Anderson Services L.L.C. (collectively, “Anderson News”)

filed an antitrust lawsuit in the U.S. District Court for the Southern District of New York against several

magazine publishers, distributors and wholesalers, including Time Inc. and one of its subsidiaries, Time/Warner

Retail Sales & Marketing, Inc. Plaintiffs allege that defendants violated Section 1 of the Sherman Antitrust Act

by engaging in an antitrust conspiracy against Anderson News, as well as other related state law claims. Plaintiffs

are seeking unspecified monetary damages. On August 2, 2010, the court granted defendants’ motions to dismiss

the complaint with prejudice and, on October 25, 2010, the court denied Anderson News’ motion for

reconsideration of that dismissal. On November 8, 2010, Anderson News filed a notice of appeal with the U.S.

Court of Appeals for the Second Circuit.

The Company intends to vigorously defend against or prosecute, as applicable, the matters described above.

The Company establishes an accrued liability for legal claims when the Company determines that a loss is

both probable and the amount of the loss can be reasonably estimated. Once established, accruals are adjusted

from time to time, as appropriate, in light of additional information. The amount of any loss ultimately incurred

in relation to matters for which an accrual has been established may be higher or lower than the amounts accrued

for such matters.

For matters disclosed above for which a loss is probable or reasonably possible, whether in excess of an

accrued liability or where there is no accrued liability, the Company has estimated a range of possible loss. The

Company believes the estimate of the aggregate range of possible loss in excess of accrued liabilities for such

matters is between $0 and $80 million at December 31, 2011. The estimated aggregate range of possible loss is

subject to significant judgment and a variety of assumptions. The matters represented in the estimated aggregate

range of possible loss will change from time to time and actual results may vary significantly from the current

estimate.

In view of the inherent difficulty of predicting the outcome of litigation and claims, the Company often

cannot predict what the eventual outcome of the pending matters will be, what the timing of the ultimate

resolution of these matters will be, or what the eventual loss, fines or penalties related to each pending matter

may be. An adverse outcome in one or more of these matters could be material to the Company’s results of

operations or cash flows for any particular reporting period.

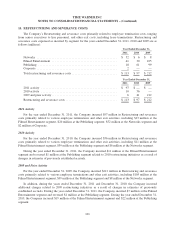

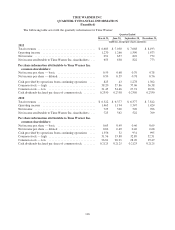

17. RELATED PARTY TRANSACTIONS

The Company has entered into certain transactions in the ordinary course of business with unconsolidated

investees accounted for under the equity method of accounting. These transactions have been executed on terms

comparable to the terms of transactions with unrelated third parties and primarily include the licensing of

broadcast rights to The CW broadcast network for film and television product by the Filmed Entertainment

segment and the licensing of rights to carry television programming provided by the Networks segment.

Revenues from transactions with related parties were $472 million, $360 million and $316 million for the

years ended December 31, 2011, 2010 and 2009, respectively. Expenses from transactions with related parties

were $63 million, $62 million and $54 million for the years ended December 31, 2011, 2010 and 2009,

respectively.

109