Time Magazine 2011 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2011 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)

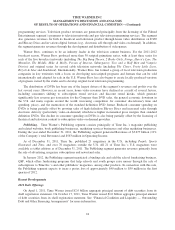

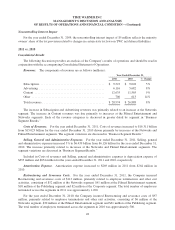

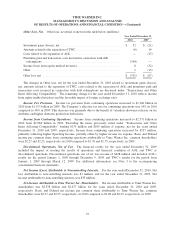

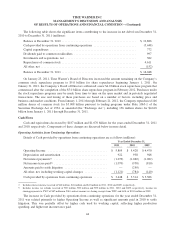

Publishing. Revenues and Operating Income of the Publishing segment for the years ended December 31,

2011 and 2010 are as follows (millions):

Year Ended December 31,

2011 2010 % Change

Revenues:

Subscription ......................................... $ 1,271 $ 1,291 (2%)

Advertising ......................................... 1,923 1,935 (1%)

Content ............................................ 84 68 24%

Other .............................................. 399 381 5%

Total revenues ......................................... 3,677 3,675 —

Costs of revenues(a) ...................................... (1,400) (1,359) 3%

Selling, general and administrative(a) ........................ (1,537) (1,580) (3%)

Asset impairments ...................................... (17) (11) 55%

Restructuring and severance costs .......................... (18) (61) (70%)

Depreciation .......................................... (100) (108) (7%)

Amortization .......................................... (42) (41) 2%

Operating Income ...................................... $ 563 $ 515 9%

(a) Costs of revenues and Selling, general and administrative expenses exclude depreciation.

Subscription revenues decreased primarily due to lower domestic newsstand sales of $23 million,

particularly in the celebrity category, and lower international subscription revenues of $16 million primarily due

to the disposal by sale of certain magazines at IPC in the fourth quarter of 2010 (the “IPC Sales”), partially offset

by higher domestic subscription sales of $18 million.

Advertising revenues decreased primarily reflecting lower international advertising revenues of $11 million

due primarily to the IPC Sales and lower website advertising revenues of $9 million due to the negative impact of

the transfer of management of the SI.com and Golf.com websites to Turner in the fourth quarter of 2010. These

decreases were partially offset by higher custom publishing revenues of $12 million.

The increase in Other revenues was due to the license fee for SI.com and Golf.com received from Turner

following the transfer of the websites’ management to Turner.

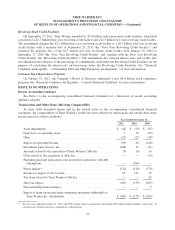

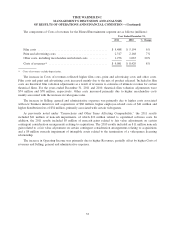

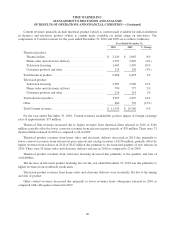

The components of Costs of revenues for the Publishing segment are as follows (millions):

Year Ended December 31,

2011 2010 % Change

Production costs .......................................... $ 848 $ 807 5%

Editorial costs ........................................... 474 472 —

Other .................................................. 78 80 (3%)

Costs of revenues(a) ........................................ $ 1,400 $ 1,359 3%

(a) Costs of revenues exclude depreciation.

Costs of revenues increased primarily due to higher production costs, which largely reflected higher paper

costs.

34